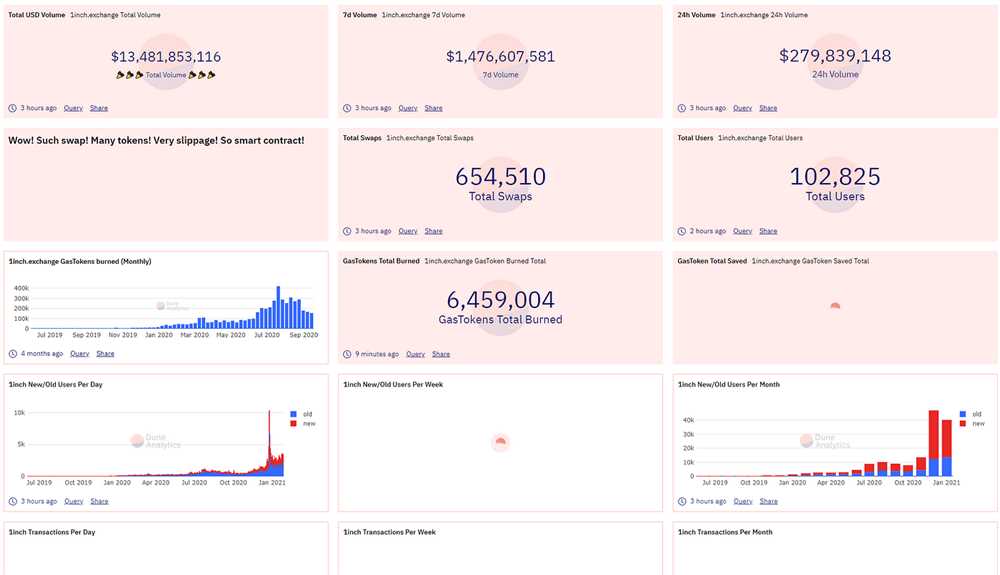

The rise of decentralized exchanges (DEXs) has revolutionized the way we trade digital assets. One of the leading names in this space is the 1inch Exchange App. Built on the Ethereum blockchain, the 1inch Exchange App enables users to trade tokens across multiple DEXs with minimal slippage and the best possible rates.

Tokenomics play a crucial role in the success and sustainability of any blockchain project. In the case of the 1inch Exchange App, its native token, 1INCH, serves as the lifeblood of its ecosystem. Holding 1INCH tokens grants users various benefits such as lower trading fees, access to premium features, and the ability to participate in governance decisions.

One of the unique features of the 1inch Exchange App’s tokenomics is its staking mechanism. Users can stake their 1INCH tokens to earn rewards in the form of additional tokens. These rewards are generated through protocol fees collected by the 1inch Network. This incentive encourages users to hold onto their tokens and actively participate in the growth of the 1inch ecosystem.

Another important aspect of the 1inch Exchange App’s tokenomics is its burning mechanism. A portion of the protocol fees collected by the 1inch Network is used to buy back and burn 1INCH tokens from the market. This creates a deflationary effect, reducing the total supply of 1INCH tokens over time. As the supply decreases, the demand for the token is expected to increase, potentially leading to a rise in its value.

In conclusion, the tokenomics of the 1inch Exchange App plays a vital role in incentivizing user participation and ensuring the long-term sustainability of the platform. Through its staking and burning mechanisms, the 1inch Network aims to create a vibrant and thriving ecosystem around its native token, 1INCH.

Understanding Tokenomics

Tokenomics refers to the economics of a cryptocurrency or token. It encompasses the study of the token’s distribution, circulation, and value creation mechanisms. Understanding tokenomics is crucial for investors and users of a decentralized application (DApp) like the 1inch Exchange app, as it helps them evaluate the long-term viability and potential of the token.

Token Distribution:

The distribution of tokens plays a critical role in tokenomics. It determines who holds the tokens and in what proportion. In the case of the 1inch token (1INCH), its distribution is governed by an Initial DEX Offering (IDO), where a portion of the tokens are allocated to the public, team members, advisors, investors, and liquidity providers.

Token Circulation:

Token circulation refers to the movement and transfer of tokens within the ecosystem. The 1inch token is an ERC-20 token built on the Ethereum blockchain, which means it can be easily traded and transferred on various decentralized exchanges and wallets. The circulation of the 1inch token is facilitated by its integration with popular DeFi platforms, allowing users to seamlessly swap and provide liquidity.

Value Creation Mechanisms:

Value creation mechanisms are the processes or factors that contribute to the appreciation or depreciation of a token’s value. In the case of the 1inch token, there are several value creation mechanisms at play. Firstly, the 1inch Exchange app offers efficient and cost-effective crypto trading by aggregating liquidity from multiple decentralized exchanges (DEXs). This attracts users, increases trading volume, and ultimately drives demand for the 1inch token. Additionally, the 1inch token has governance rights, allowing holders to participate in protocol upgrades and decision-making, which adds value to the token.

The Importance of Tokenomics

Understanding tokenomics is crucial for investors and users alike. Investors can assess the potential long-term value of a token by analyzing its distribution, circulation, and value creation mechanisms. This information can help them make informed investment decisions. Users, on the other hand, can benefit from understanding tokenomics as it allows them to participate in the token’s ecosystem more effectively, take advantage of incentives, and contribute to its growth.

The 1inch Tokenomics

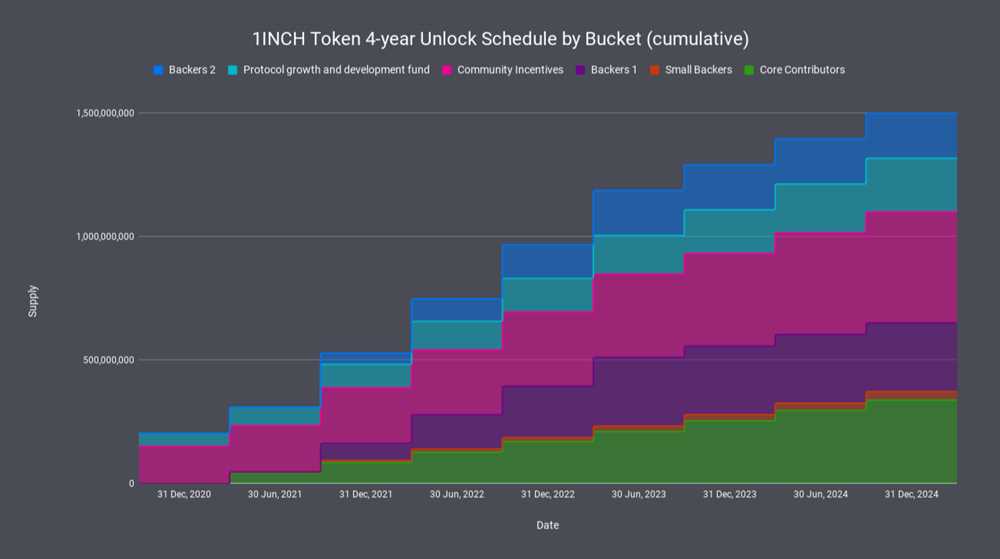

The 1inch token has a total supply of 1.5 billion tokens. Out of this supply, 6% was allocated for the IDO, 14.5% is reserved for community incentives, 10% is allocated for team members and advisors, 15% is set aside for future protocol growth, 19% for the 1inch Foundation, and the remaining 35.5% for liquidity mining rewards. This distribution aims to incentivize various stakeholders and ensure the long-term sustainability of the protocol.

In conclusion, understanding tokenomics is essential for evaluating the potential of a cryptocurrency or token. The distribution, circulation, and value creation mechanisms are key factors that determine the success of a token in the long run. In the context of the 1inch Exchange app, comprehending its tokenomics can help investors and users make informed decisions and contribute to the growth of the ecosystem.

The 1inch Exchange App

The 1inch Exchange App is a decentralized exchange aggregator that aims to provide users with the best possible trading prices across various decentralized exchanges (DEXs). It allows users to optimize their trades by splitting them across multiple DEXs, taking advantage of different liquidity pools and protocols.

With the 1inch Exchange App, users can easily swap tokens at the best available rates without needing to manually search and compare prices on different exchanges. The app aggregates liquidity from major DEXs, such as Uniswap, SushiSwap, Balancer, and many others, to ensure users get the most favorable rates.

One of the key features of the 1inch Exchange App is its Gas Token technology. Gas Tokens are a way of reducing transaction costs on the Ethereum network. The app allows users to convert any excess gas from a trade into Gas Tokens, which can then be used to pay for future transaction fees, effectively reducing the overall cost of using the platform.

Key Features of the 1inch Exchange App:

- Smart Contract Optimizer: The app utilizes a smart contract optimizer to minimize gas fees and reduce the time it takes for transactions to be confirmed on the Ethereum network.

- Advanced Order Routing: The app intelligently routes orders to different DEXs to ensure users get the best possible rates and the highest liquidity.

- Security: The app uses audited and secure smart contracts to protect user funds and ensure the integrity of trades.

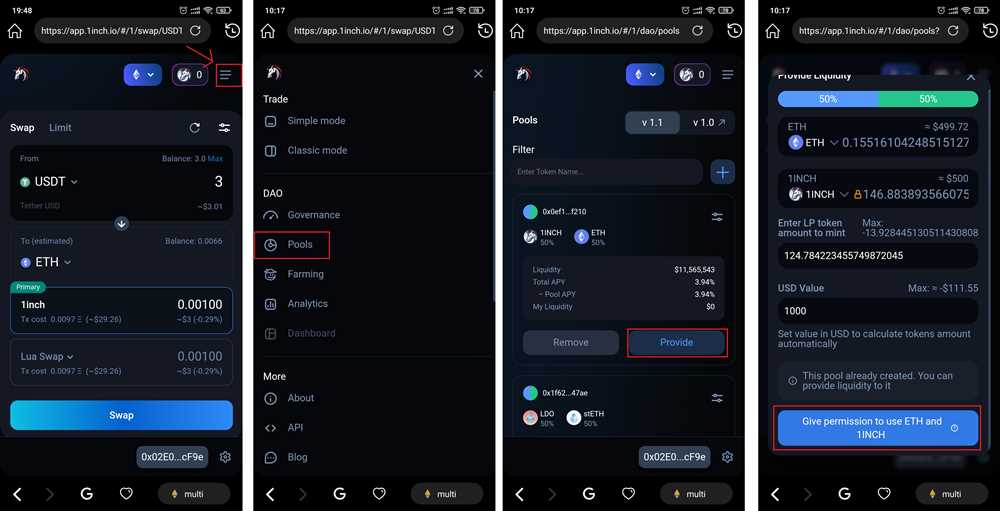

The 1inch Exchange App is available both as a web application and as a mobile app, making it accessible and convenient for users to trade on the go. The intuitive user interface and user-friendly design make it easy for both experienced traders and beginners to navigate the platform and execute trades efficiently.

In summary, the 1inch Exchange App is a powerful decentralized exchange aggregator that provides users with the best trading prices by leveraging multiple DEXs. Its gas token technology and advanced features make it an attractive choice for anyone looking to trade tokens in a fast, efficient, and cost-effective manner.

Key Features of the App

The 1inch Exchange app offers a variety of key features that make it a powerful and convenient tool for users:

- Aggregation of Liquidity: The app combines liquidity from various decentralized exchanges (DEXs), allowing users to access a wide range of trading options and liquidity pools.

- Optimal Routing: The app utilizes sophisticated algorithms to find the most efficient trading routes across multiple DEXs, ensuring users get the best possible prices and minimal slippage.

- Low Fees: With its decentralized infrastructure, the app reduces intermediary fees, resulting in lower transaction costs for users.

- Gas Token Optimization: The app uses the Gas Token mechanism to reduce gas fees and optimize transaction costs on the Ethereum network.

- Limits and Slippage Control: Users can set customizable limits and slippage percentages to control the execution of their trades and minimize the risk of unexpected price changes.

- Multiple Networks: The app supports various blockchain networks, including Ethereum, Binance Smart Chain, and Polygon, offering users the flexibility to trade on their preferred network.

- Advanced Security Measures: The app prioritizes security, utilizing audited smart contracts and code, as well as integrating with popular wallets for secure asset management.

- User-Friendly Interface: The app features an intuitive and user-friendly interface, making it easy for users to navigate and execute trades quickly and efficiently.

- Community Governance: The 1inch Exchange operates with a DAO (Decentralized Autonomous Organization) model, allowing users to participate in the platform’s governance and decision-making processes.

These key features, among others, make the 1inch Exchange app a popular choice for users looking to access decentralized liquidity and optimize their trading strategies.

Tokenomics of the 1inch Exchange App

The 1inch Exchange app operates on a unique tokenomic model, which is designed to incentivize and reward active users of the platform. The native token of the 1inch Exchange app is the 1INCH token, which serves multiple purposes within the ecosystem.

Token Utility

The 1INCH token has various utilities within the 1inch Exchange app. Firstly, holders of the token can participate in the platform’s governance through voting rights. This allows token holders to have a say in the direction and development of the platform.

Additionally, the 1INCH token is used to pay for transaction fees on the 1inch Exchange app. Users can choose to pay these fees in the native token, which provides a discount on the overall transaction cost.

Liquidity Mining

The 1inch Exchange app also offers a liquidity mining program, where users can earn rewards in 1INCH tokens by providing liquidity to the platform. Liquidity providers are incentivized with a portion of the trading fees generated on the platform, which is distributed in the form of 1INCH tokens.

The amount of 1INCH tokens earned through liquidity mining is proportional to the amount of liquidity provided by the user. This encourages users to contribute more liquidity to the platform, which in turn increases the overall trading volume and liquidity available.

Staking

Furthermore, the 1inch Exchange app allows users to stake their 1INCH tokens and earn additional rewards. By staking 1INCH tokens, users can participate in the platform’s governance and receive a portion of the transaction fees generated on the platform.

The rewards earned through staking are distributed in 1INCH tokens and serve as a way to incentivize long-term engagement and participation in the platform.

Overall, the tokenomics of the 1inch Exchange app are designed to create a vibrant and active ecosystem. The 1INCH token serves as the fuel for the platform, providing users with various utilities and rewards for their participation and contribution.

Token Distribution and Supply

Token distribution and supply are crucial aspects of any cryptocurrency project. Understanding how tokens are distributed and the total supply of tokens can provide valuable insights into the project’s potential for growth and sustainability.

Initial Token Distribution

The 1inch Exchange app’s native token, 1INCH, had an initial distribution through a liquidity mining program. This program incentivized users to provide liquidity to specific liquidity pools on the 1inch Exchange. As a reward for their participation, users received 1INCH tokens.

The liquidity mining program was designed to distribute tokens in a fair manner, allowing users to earn tokens based on the amount of liquidity they provided. This approach ensured a decentralized distribution of tokens and helped bootstrap the liquidity on the exchange.

The initial token distribution was an important step in creating a vibrant and active ecosystem around the 1inch Exchange. By incentivizing liquidity providers, the project was able to attract a diverse range of participants who were willing to contribute to the growth of the platform.

Total Token Supply

The total supply of 1INCH tokens is fixed at 1.5 billion tokens. This means that there will never be more than 1.5 billion tokens in existence. The fixed supply helps create scarcity and can potentially drive up demand for the tokens.

Of the total token supply, a portion was allocated for the initial liquidity mining program, while the remaining tokens were allocated to different purposes, such as ecosystem development, community grants, partnerships, and team and advisors.

| Token Allocation | Percentage |

|---|---|

| Initial Liquidity Mining | 30% |

| Ecosystem Development | 14.5% |

| Community Grants | 10% |

| Partnerships | 6% |

| Team and Advisors | 39.5% |

The allocation of tokens for ecosystem development, community grants, partnerships, and team and advisors ensures that resources are available to support the growth and development of the project. It also provides incentives for the team and advisors to contribute their expertise and guidance.

By understanding the token distribution and supply of the 1inch Exchange app, users and investors can gain a better understanding of the project’s underlying dynamics and long-term prospects. This knowledge can help inform investment decisions and provide insights into the potential value of the 1INCH token.

Utility and Governance of the 1inch Token

The 1inch token (1INCH) is the native utility token of the 1inch Exchange platform. It serves multiple purposes within the ecosystem, including:

1. Fee Discounts

Holders of the 1INCH token are entitled to fee discounts when trading on the 1inch Exchange. By using 1INCH to pay for transaction fees, users can receive reduced trading costs compared to those who do not hold the token.

2. Liquidity Mining

1INCH token holders also have the opportunity to participate in liquidity mining programs. By providing liquidity to supported pools on the 1inch platform, users can earn additional 1INCH tokens as rewards. This incentivizes users to contribute to the liquidity of the platform and helps ensure a healthy trading environment.

3. Governance Rights

The 1INCH token holders have governance rights within the 1inch ecosystem. They can participate in voting and decision-making processes that determine the direction and policies of the platform. This includes voting on proposals such as protocol upgrades, fee structures, and other changes to the platform’s functionality.

4. Protocol Staking

In addition to governance rights, 1INCH token holders can also stake their tokens in the 1inch protocol. By staking their tokens, users can contribute to the security and stability of the platform and in return earn staking rewards. This provides an additional incentive for holding and participating in the 1inch ecosystem.

In summary, the 1inch token is a key component of the 1inch Exchange platform, providing utility, governance rights, and staking opportunities for its holders. By leveraging these features, users can benefit from fee discounts, liquidity mining rewards, and participate in shaping the future of the platform.

Question-answer:

What is the 1inch Exchange App?

The 1inch Exchange App is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges and allows users to swap and trade tokens at the best possible rates.

How does the 1inch Exchange App work?

The 1inch Exchange App works by automatically splitting a user’s trades across multiple decentralized exchanges to find the best prices and lowest slippage. It uses an algorithm called Pathfinder to optimize the trade routing and ensure users get the best possible rates.

What are the benefits of using the 1inch Exchange App?

The 1inch Exchange App offers several benefits to users. Firstly, it provides access to a wide range of decentralized exchanges and pools, increasing liquidity and trade options. Secondly, its algorithm helps users minimize slippage and get the best possible rates for their trades. Lastly, the app has a user-friendly interface and offers features like limit orders and liquidity mining.