Decentralized finance (DeFi) has gained significant traction in recent years, offering users a truly transparent and decentralized alternative to traditional financial systems. One of the key components of DeFi is the emergence of decentralized exchanges, which allow users to trade cryptocurrencies directly from their wallets, without the need for intermediaries.

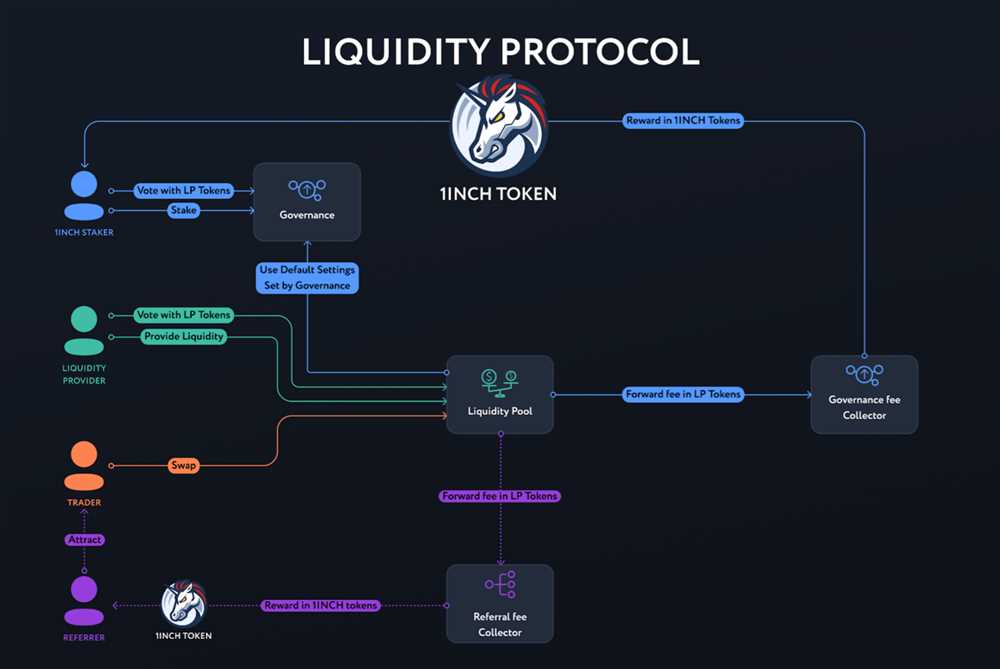

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. In order to facilitate its operations, 1inch has its own native token, aptly named 1inch token. This token serves multiple purposes within the 1inch ecosystem, including governance rights and as a reward for liquidity providers.

In comparison, centralized exchanges (CEXs) are the more traditional option for trading cryptocurrencies. These platforms act as intermediaries, holding users’ funds in centralized wallets and executing trades on their behalf. CEXs often have their own native tokens as well, which can offer various benefits to users, such as reduced fees, enhanced trading features, or even profit sharing.

While both 1inch tokens and centralized exchange tokens have their own unique features and use cases, there are some key differences between them. The most significant difference is the level of decentralization. 1inch tokens are native to a decentralized exchange aggregator, which operates on various protocols and sources liquidity from decentralized exchanges. On the other hand, centralized exchange tokens are associated with centralized platforms, which rely on a single entity to hold users’ funds and execute trades.

Another important distinction is the governance aspect. As a 1inch token holder, users have the ability to participate in the governance of the 1inch ecosystem by voting on proposals and decisions. This gives token holders a say in the future development and direction of the 1inch platform. In contrast, centralized exchange tokens typically do not offer governance rights, as the decision-making power lies solely with the centralized exchange.

Key Features of 1inch Tokens

1inch tokens are an integral part of the 1inch decentralized exchange ecosystem and hold several key features that distinguish them from centralized exchange tokens.

Utility and Governance

1inch tokens, also known as 1INCH tokens, serve multiple functions within the 1inch ecosystem. They act as a utility token, powering various aspects of the decentralized exchange platform such as fee settlement, staking, and participation in platform governance.

Token holders can stake their 1INCH tokens to participate in the 1inch Liquidity Protocol’s governance, giving them the ability to vote on proposals and shape the direction of the platform. The decentralized nature of the governance process ensures that decisions are made collectively by the token holders, rather than being controlled by a central authority.

Liquidity Mining

1inch tokens can also be obtained through liquidity mining incentives, where users can earn additional tokens by providing liquidity to the 1inch exchange. This incentivizes users to contribute to the liquidity pool, enhancing the overall efficiency and depth of the platform.

Through liquidity mining, users can earn rewards in the form of 1INCH tokens, providing an opportunity for users to passively grow their holdings while actively participating in the decentralized exchange ecosystem.

Decentralization and Trustlessness

1inch tokens are designed to promote decentralization and trustlessness, which are core principles of the decentralized finance (DeFi) movement. By utilizing smart contracts and an automated market maker (AMM) model, the 1inch exchange removes the need for intermediaries and central authorities, allowing users to trade assets in a peer-to-peer manner.

This decentralized model not only removes the reliance on centralized exchanges but also eliminates the need for users to trust a single entity to securely handle their funds. Instead, transactions on the 1inch platform are executed by the smart contracts, ensuring transparency and security.

| Key Features of 1inch Tokens |

|---|

| Utility and Governance |

| Liquidity Mining |

| Decentralization and Trustlessness |

Key Features of Centralized Exchange Tokens

Centralized exchange tokens, also known as CEX tokens, are digital assets that are issued by centralized exchange platforms. These tokens serve various purposes within the ecosystem of the exchange and offer a range of features that make them unique. Here are some key features of centralized exchange tokens:

- Utility: CEX tokens have utility within the exchange platform, providing users with various benefits. These benefits can include reduced trading fees, priority access to new features and products, and enhanced customer support.

- Loyalty Programs: Many centralized exchanges have loyalty programs in place where users can earn rewards in the form of CEX tokens based on their trading activity. These tokens can be used for discounted fees, exclusive promotions, or even exchanged for other digital assets.

- Token Burning: Some centralized exchanges have token burning mechanisms in place, which involves permanently removing a certain number of tokens from circulation. This can help increase the scarcity and value of the remaining tokens.

- Voting Rights: In some cases, CEX token holders may have voting rights within the exchange platform. This allows them to participate in the decision-making process and influence the direction of the platform’s development.

- Rewards for Holding: Holding CEX tokens for a certain period of time can sometimes entitle token holders to additional rewards. These rewards can include airdrops of new tokens or a share of the exchange’s profits.

- Discounted Services: Some centralized exchanges offer discounted services for users who hold a certain amount of CEX tokens. These services can include margin trading, lending, or even access to exclusive investment opportunities.

- Interoperability: In certain cases, centralized exchange tokens can be used as a form of collateral or for cross-chain transactions between different blockchain networks. This enhances their utility and allows for more seamless integration with other decentralized platforms.

These are just a few examples of the key features that centralized exchange tokens can offer. As the cryptocurrency market continues to evolve, it is likely that we will see new innovative features and use cases for these tokens.

Question-answer:

What is the difference between 1inch tokens and centralized exchange tokens?

There are several differences between 1inch tokens and centralized exchange tokens. Firstly, 1inch tokens are native to the 1inch decentralized exchange protocol, while centralized exchange tokens are typically issued by centralized exchanges as a means of representing ownership or providing certain benefits within the platform. Additionally, 1inch tokens are generally designed to democratize access to decentralized finance (DeFi), while centralized exchange tokens are more focused on providing benefits within the centralized exchange ecosystem. Lastly, 1inch tokens often have a more decentralized governance model, allowing token holders to have a say in protocol decisions, whereas centralized exchanges usually have more centralized control over their platforms.

What are some advantages of 1inch tokens over centralized exchange tokens?

There are several advantages of 1inch tokens over centralized exchange tokens. Firstly, 1inch tokens often have more utility within the broader DeFi ecosystem, as they can be used across multiple decentralized exchanges and platforms. This allows users to access a wider range of liquidity and trading options. Additionally, 1inch tokens often have more transparent and decentralized governance models, giving users a greater say in the direction and decision-making of the protocol. This can help ensure that the platform remains aligned with the interests of the community. Lastly, 1inch tokens can also provide opportunities for users to participate in network rewards and incentives, allowing them to earn additional tokens for their participation in the ecosystem.

Are there any disadvantages of 1inch tokens compared to centralized exchange tokens?

While 1inch tokens have many advantages, there are also some potential disadvantages compared to centralized exchange tokens. Firstly, 1inch tokens may have lower liquidity compared to centralized exchange tokens, as they are typically traded on decentralized exchanges that may have lower trading volumes. This can result in higher slippage and less efficient trading experiences for users. Additionally, 1inch tokens may have higher transaction fees and slower transaction times compared to centralized exchange tokens due to the nature of decentralized exchanges. Lastly, since decentralized exchanges operate on the blockchain, there may be additional complexities and technical barriers for users who are less familiar with blockchain technology compared to centralized exchanges which often have more user-friendly interfaces.