Introducing 1inch, the solution to the persistent problem of front-running in the rapidly growing world of decentralized finance (DeFi).

In the exciting and dynamic DeFi space, front-running has been a major concern for traders. This unethical practice allows opportunistic individuals to exploit the time delay between transaction submission and execution, giving them an unfair advantage in the market.

However, 1inch is here to change the game. With its innovative and secure protocol, 1inch ensures that traders enjoy a fair and transparent trading experience, free from front-running manipulation.

How does 1inch accomplish this? By utilizing its advanced algorithms and decentralized infrastructure, 1inch is able to detect and prevent front-running attempts in real-time. This groundbreaking technology guarantees that your transactions are executed at the intended price, without interference from malicious actors.

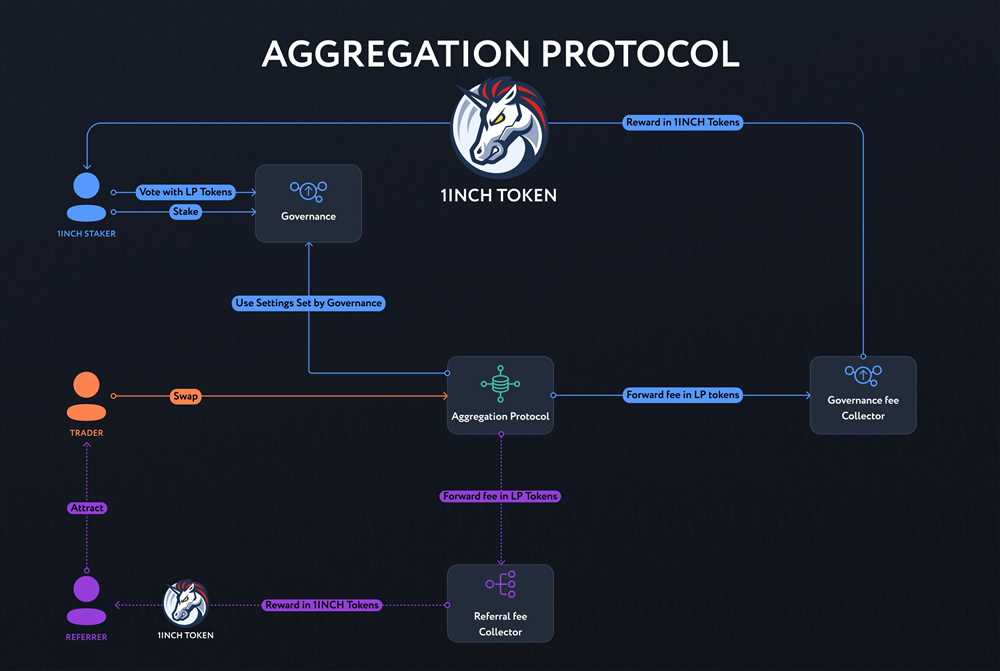

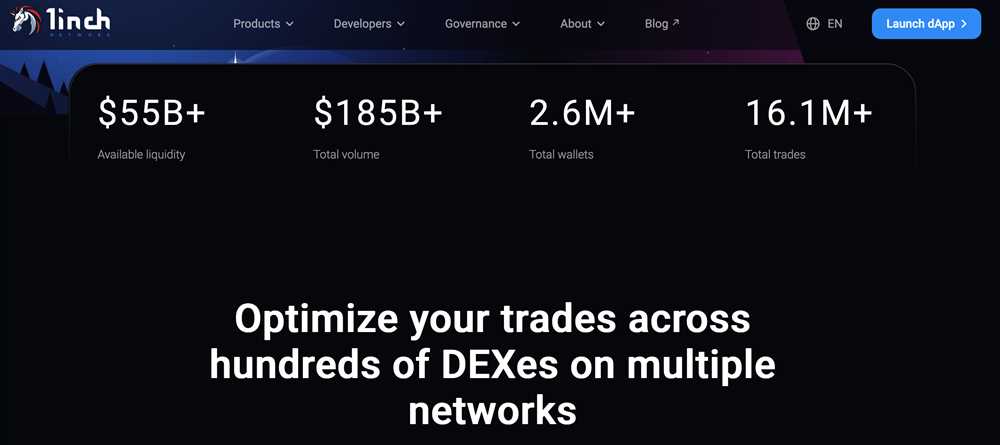

Not only does 1inch protect your trades, but it also offers the best possible prices. Through its unique aggregation and routing system, 1inch scans multiple exchanges and liquidity sources to find the most favorable rates for your transactions. This means you can trade with confidence, knowing that you are getting the best possible deal.

Don’t let front-runners ruin your DeFi experience. Take control of your trades with 1inch and enjoy a fair and efficient decentralized trading environment.

Try 1inch today and join the revolution against front-running in DeFi!

The Problem

Front-running has become a significant issue in the decentralized finance (DeFi) space. It occurs when a trader or a group of traders exploit information asymmetry by placing trades ahead of others based on privileged knowledge. This unfair practice can result in significant financial losses for unsuspecting participants.

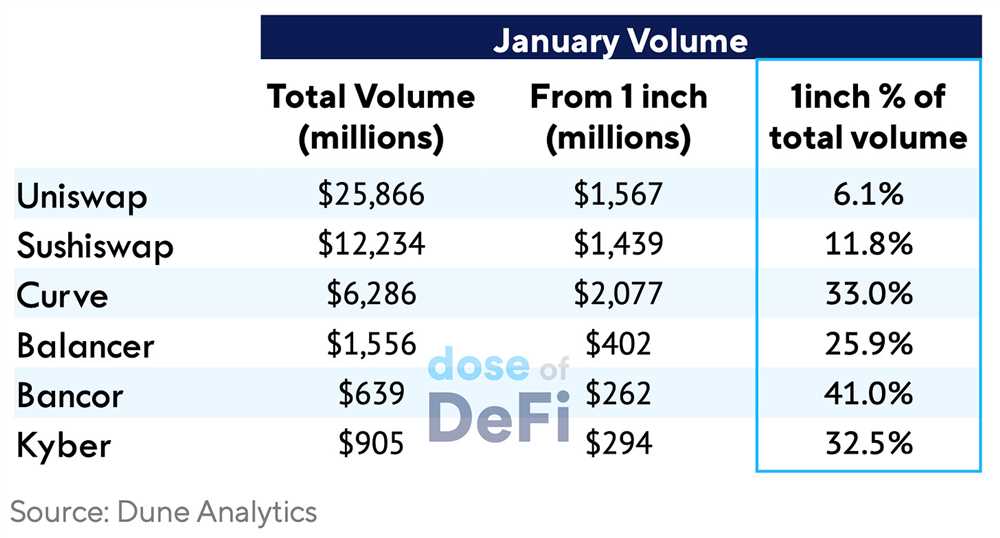

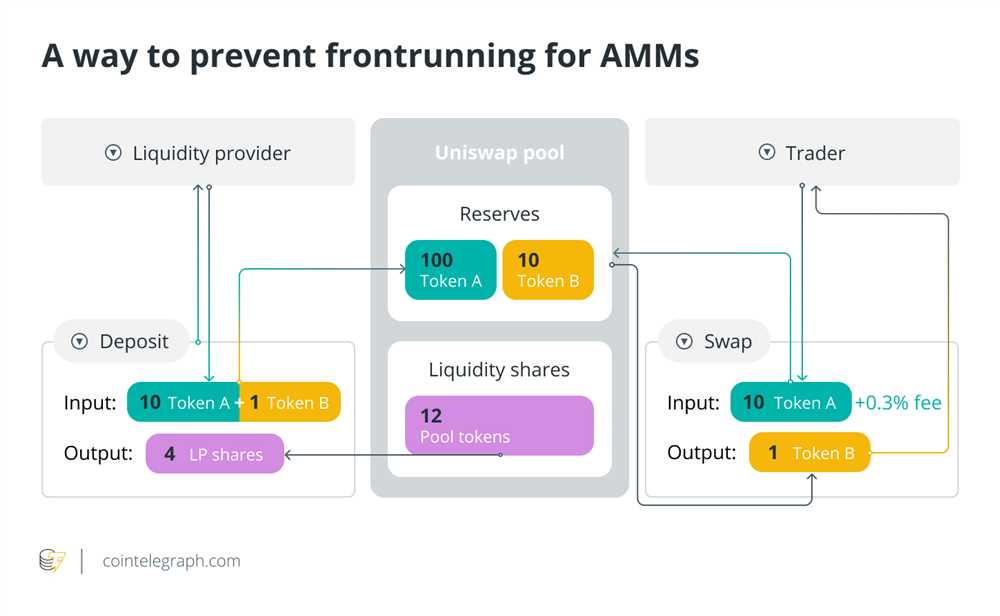

Front-running is particularly prevalent in DeFi due to the transparency of blockchain transactions and the open nature of decentralized exchanges. With the growing popularity of DeFi protocols like Uniswap and Curve, front-running has become a pressing concern for both individual traders and the DeFi community as a whole.

How Front-Running Works

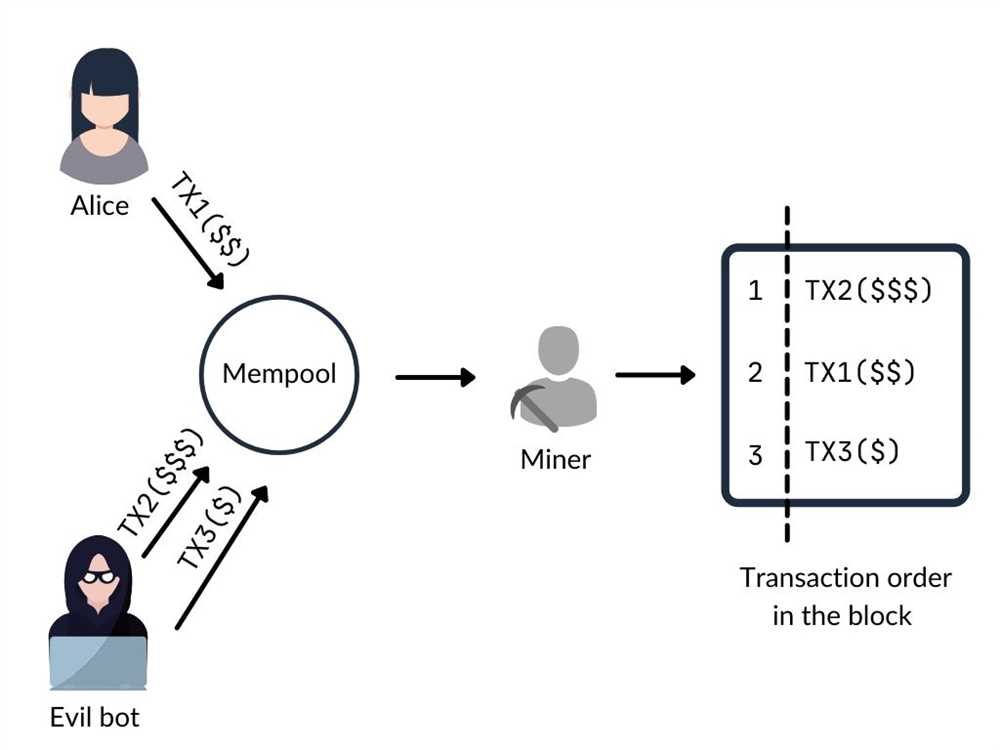

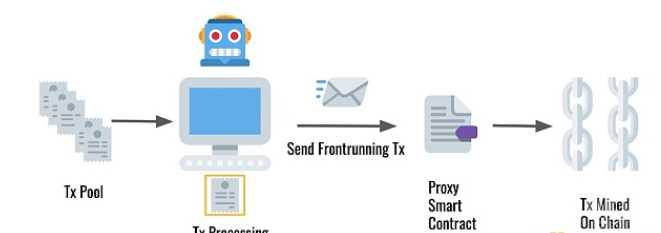

Front-running involves a dishonest actor who monitors pending transactions on the blockchain and identifies profitable trades that are about to occur. The front-runner then places their own trades in advance, taking advantage of the price impact caused by the upcoming transaction. This allows the front-runner to buy at a lower price or sell at a higher price, effectively profiting at the expense of the original trader.

Front-runners often leverage advanced trading algorithms and high-frequency trading techniques to execute their trades quickly and efficiently. These tactics enable them to capitalize on the time delay between when a transaction is submitted and when it is confirmed on the blockchain, further enhancing their unfair advantage.

The Impacts of Front-Running

Front-running not only undermines the fairness and integrity of the DeFi ecosystem but also creates instability and distrust among participants. Traders who fall victim to front-running may incur significant financial losses, discouraging their continued participation in DeFi and hindering the growth of the industry as a whole.

Moreover, front-running can lead to market manipulation, as the actions of front-runners can skew market prices and misrepresent supply and demand dynamics. This not only distorts the market but also erodes confidence in the transparency and efficiency of decentralized exchanges.

| Common Techniques Used in Front-Running: |

|---|

| Monitoring pending transactions |

| Identifying profitable trades |

| Placing trades in advance |

| Executing trades quickly and efficiently |

Front-Running in DeFi

Front-running in decentralized finance (DeFi) refers to the practice of an individual or entity executing orders ahead of other participants in the market, based on information about their pending transactions. This unethical behavior allows the front-runner to take advantage of the price movements caused by the pending transaction, resulting in financial gain at the expense of other participants.

Front-running is particularly prevalent in DeFi due to the decentralized and transparent nature of the blockchain. Transactions on DeFi platforms are recorded on a public ledger, allowing anyone to monitor pending transactions and potentially act on the information before the transaction is executed.

The Impact of Front-Running

Front-running has a number of negative implications for the DeFi ecosystem. Firstly, it undermines the fairness and integrity of the market by allowing certain participants to gain an unfair advantage over others. This discourages new participants from entering the market and hampers the overall growth of DeFi.

Secondly, front-running erodes trust in the DeFi platforms and the blockchain technology that powers them. Users may be hesitant to use these platforms if they believe that their transactions are more vulnerable to exploitation. This can hinder the adoption of DeFi and slow down its progress.

Lastly, front-running can have significant financial consequences for individual participants. By taking advantage of price movements, front-runners can manipulate the market and cause losses for other traders. This not only affects the immediate profits and losses of individual traders, but can also have wider implications for market stability.

Addressing Front-Running: 1inch Takes the Lead

1inch, a leading decentralized exchange aggregator, is taking proactive steps to address front-running in DeFi. 1inch is committed to creating a fair and transparent trading environment for all participants, and they have implemented various measures to mitigate the impact of front-running.

One of the key strategies employed by 1inch is the use of advanced algorithms and smart contract technology to minimize the risks associated with front-running. By optimizing transaction execution and reducing the time it takes for a transaction to be processed, 1inch can help level the playing field for all participants.

In addition, 1inch is constantly monitoring and analyzing the market to identify potential front-runners and take appropriate action to prevent their activities. This proactive approach helps to maintain the integrity of the market and protect the interests of all participants.

By taking the lead in addressing front-running in DeFi, 1inch is helping to create a more secure and fair environment for all participants. With their innovative solutions and commitment to transparency, 1inch is paving the way for the continued growth and development of DeFi.

| Benefits of addressing front-running in DeFi | Actions taken by 1inch to address front-running |

|---|---|

| – Fair and transparent market | – Use of advanced algorithms and smart contract technology |

| – Increased trust in DeFi platforms | – Monitoring and analyzing the market for potential front-runners |

| – Reduced financial losses for participants | – Taking proactive action to prevent front-running |

The Solution

1inch has developed a cutting-edge solution to address the issue of front-running in the DeFi space. By leveraging advanced algorithms and smart contract technology, 1inch is able to prevent front-runners from exploiting users’ transactions and profiting from their information.

Firstly, 1inch employs a sophisticated anti-front-running algorithm that detects and identifies suspicious trading patterns in real-time. This algorithm is continuously updated and refined to ensure the most effective protection against front-running attacks.

Additionally, 1inch utilizes secure and tamper-proof smart contracts to execute trades on behalf of users. These smart contracts are designed to prevent front-runners from intercepting and manipulating transactions. By ensuring fair and transparent trade execution, 1inch is able to uphold the integrity of the DeFi ecosystem.

Advanced Security Measures

1inch also implements a range of advanced security measures to further protect users’ transactions. These include robust encryption protocols, multi-factor authentication, and secure storage of users’ private keys.

Furthermore, 1inch maintains a strong partnership network with reputable auditors and security experts to conduct regular audits and penetration tests. This proactive approach to security ensures that any potential vulnerabilities are detected and addressed promptly.

Ongoing Innovation

As the DeFi space continues to evolve, 1inch remains committed to staying at the forefront of innovation. The team is constantly researching and developing new solutions to enhance the security and efficiency of the platform.

By taking a proactive approach to addressing front-running, 1inch is able to provide users with a trustworthy and secure platform to trade and interact with DeFi protocols. With its advanced technology and dedication to innovation, 1inch is leading the way in building a more secure and resilient DeFi ecosystem.

Invest in trust. Choose 1inch.

Addressing Front-Running

Front-running is a practice that occurs in decentralized finance (DeFi) where traders with inside knowledge of pending transactions can exploit the time delay between when a transaction is submitted and when it is confirmed on the blockchain.

This unethical practice allows these front-runners to profit at the expense of other market participants by executing their own transactions before the original transaction is confirmed, causing the prices to move in their favor.

The Impact of Front-Running

Front-running creates an unfair advantage for those involved in the practice, undermining the trust and integrity of DeFi platforms. It can result in significant financial losses for honest traders, as well as discourage new participants from entering the DeFi space.

Additionally, front-running undermines the efficiency and transparency of the DeFi ecosystem by distorting market prices and reducing liquidity. This can ultimately hinder the growth and adoption of DeFi as a whole.

How 1inch Takes the Lead

1inch, a leading decentralized exchange aggregator, recognizes the detrimental impact of front-running on DeFi and is taking proactive steps to address this issue.

By implementing advanced anti-front-running measures, 1inch ensures the protection of its users’ transactions and prevents front-runners from exploiting the system. These measures include transaction obfuscation, ordering randomness, and other techniques designed to make it harder for front-runners to identify and profit from pending transactions.

| Benefits of Addressing Front-Running |

|---|

| 1. Enhanced trust and integrity within the DeFi community |

| 2. Increased confidence for market participants |

| 3. Improved efficiency and transparency in DeFi |

| 4. Encouragement of widespread adoption of DeFi |

1inch is leading the way in addressing front-running in DeFi, setting an example for other platforms to follow. By prioritizing fairness and integrity, 1inch is paving the way for a more inclusive and trustworthy decentralized financial system.

The Leading Platform

1inch is the leading platform in addressing front-running in the DeFi space. Front-running has been a major concern in decentralized finance, as it allows opportunistic traders to take advantage of pending transactions by placing their own transactions ahead of them. This unethical practice can result in losses for users and undermines the trust in the DeFi ecosystem.

1inch recognized this problem and developed innovative solutions to mitigate front-running. By using advanced algorithms and smart contract technology, 1inch ensures that user transactions receive fair and equal treatment. The platform monitors the blockchain for potential front-running activities and employs strategies to minimize the risk.

With its efficient and secure protocol, 1inch provides users with the peace of mind that their transactions are protected from front-runners. By combining speed, reliability, and security, 1inch has established itself as the go-to platform for traders and investors in the DeFi space.

By choosing 1inch, users can enjoy a transparent and trustworthy trading experience. The platform’s dedication to combat front-running sets it apart from its competitors, making it the leader in the industry. Whether you are a seasoned trader or just starting your DeFi journey, 1inch is the platform you can rely on to navigate the decentralized finance landscape with confidence.

Choose 1inch, the leading platform in addressing front-running in DeFi, and take control of your transactions today.

inch Takes the Lead

With its innovative approach to addressing front-running in the decentralized finance (DeFi) space, 1inch has emerged as a leader in the industry. Front-running, a practice where traders take advantage of advanced knowledge of pending transactions, has long been a concern in DeFi. However, 1inch’s unique technology has proven to be a game-changer, providing users with a safe and fair trading experience.

By implementing a multi-chain approach and using advanced algorithms, 1inch has been able to significantly reduce the risk of front-running. The platform constantly monitors transaction data and market conditions to detect and prevent front-running attempts in real-time. This ensures that all users, regardless of their trading size or experience, have equal opportunities in the market.

One of the key features that sets 1inch apart is its efficient routing system. The platform leverages multiple liquidity sources to deliver the best available prices to users. This not only increases liquidity but also minimizes the chances of front-running by reducing the predictability of transactions.

Furthermore, 1inch is committed to transparency and security. The platform undergoes regular security audits and has implemented measures to protect users’ funds and data. With an easy-to-use interface and a wide range of supported tokens, 1inch provides a seamless trading experience for both beginners and experienced traders.

As the DeFi space continues to grow, front-running remains a challenge that needs to be addressed. 1inch’s innovative solutions and commitment to user fairness have positioned it as a leader in the industry. With its efficient routing system, constant monitoring, and commitment to security, 1inch is empowering users to trade with confidence, knowing that their transactions are being executed fairly.

Join the revolution in decentralized finance and experience the power of 1inch today!

Question-answer:

What is “Addressing Front-Running in DeFi: 1inch Takes the Lead” about?

“Addressing Front-Running in DeFi: 1inch Takes the Lead” is about 1inch, a decentralized exchange aggregator, and their efforts to tackle the issue of front-running in the DeFi space.

What is front-running in DeFi?

Front-running in DeFi refers to the unethical trading practice where a trader takes advantage of their knowledge of incoming transactions before they are executed on the blockchain. They can then execute their own trades before the original transactions, leading to unfair profits.

How does 1inch address front-running in DeFi?

1inch addresses front-running in DeFi by implementing a solution called “Chi Gas Token.” This token is essentially a way to make transactions more expensive for front-runners, ultimately making it less profitable for them to engage in front-running activities.