Decentralized Finance (DeFi) has revolutionized the financial industry by introducing innovative concepts and opportunities for users worldwide. One of the most intriguing features of DeFi is the concept of flash loans, which allow users to borrow and repay funds within the same transaction, without providing collateral. In this comprehensive guide, we will dive into the world of flash loans on the 1inch platform, exploring how they work, their benefits and risks, and how you can take advantage of this groundbreaking technology.

What are flash loans?

Flash loans are a type of uncollateralized loan that can be borrowed and repaid within a single Ethereum transaction. This means that users can borrow a large sum of money without having to provide any collateral or meet traditional borrowing requirements. Flash loans are made possible through the use of smart contracts, which automatically execute the loan and repayment operations.

How do flash loans work on 1inch?

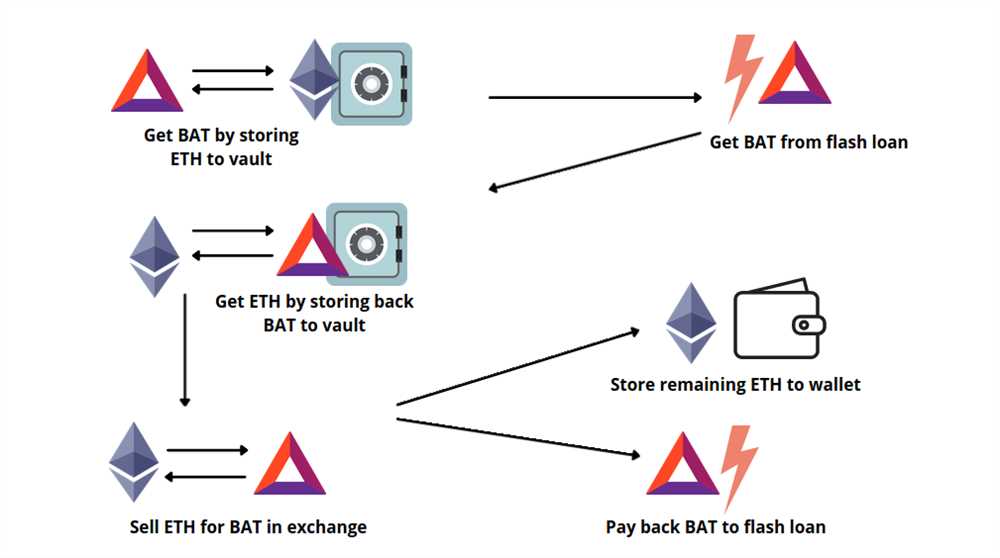

1inch is a leading decentralized exchange aggregator that supports flash loans on its platform. When a user requests a flash loan on 1inch, the platform borrows the requested amount from various liquidity pools. The borrowed funds are then used to perform a series of operations, such as arbitrage, complex trades, or collateral swaps, to generate profit. Once the transaction is complete, including the repayment of the borrowed funds and any fees, the flash loan is considered successful.

The benefits and risks of flash loans

Flash loans offer several benefits to users, including the ability to access large amounts of funds without collateral, low transaction fees, and the potential for high returns. However, there are also risks associated with flash loans, such as the risk of price manipulation, technical vulnerabilities, and the possibility of losing borrowed funds due to unsuccessful transactions. It is crucial for users to understand these risks and thoroughly research the projects and protocols they engage with when using flash loans.

Conclusion

Flash loans have emerged as a powerful tool in the DeFi space, offering users unprecedented access to funds and opportunities for profit. 1inch has played a pivotal role in bringing flash loans to the forefront of DeFi, providing a reliable and user-friendly platform for users to leverage this innovative financial tool. As the DeFi industry continues to evolve, it is important to stay informed about the benefits and risks of flash loans, and to approach them with caution and careful consideration.

What are Flash Loans and How Do They Work?

Flash loans are a unique feature in decentralized finance (DeFi) that allow users to borrow a large amount of assets without requiring any collateral. They have gained popularity due to their ability to exploit arbitrage opportunities and perform complex transactions within a single Ethereum block.

Flash loans work by leveraging the composability and liquidity of DeFi protocols. Users can borrow assets from lending pools for a short duration, typically within a single transaction, and must repay the loan amount by the end of the transaction. If the loan is not repaid, the entire transaction is reverted, and no fees or interest are incurred.

Flash loans are executed using smart contracts, which facilitate the automated borrowing and repayment process. When a user initiates a flash loan, the smart contract performs multiple operations, such as borrowing the desired assets, executing the desired transaction(s), and repaying the loan amount, all within the same atomic transaction.

Key Features of Flash Loans

Flash loans have several notable features that make them unique:

- No collateral required: Unlike traditional loans, flash loans do not require borrowers to provide any collateral. This allows users to access a large amount of capital without any upfront investment.

- Instant and permissionless: Flash loans are executed instantly and do not require any approvals or intermediaries. Users can access funds directly from lending pools by interacting with the smart contract.

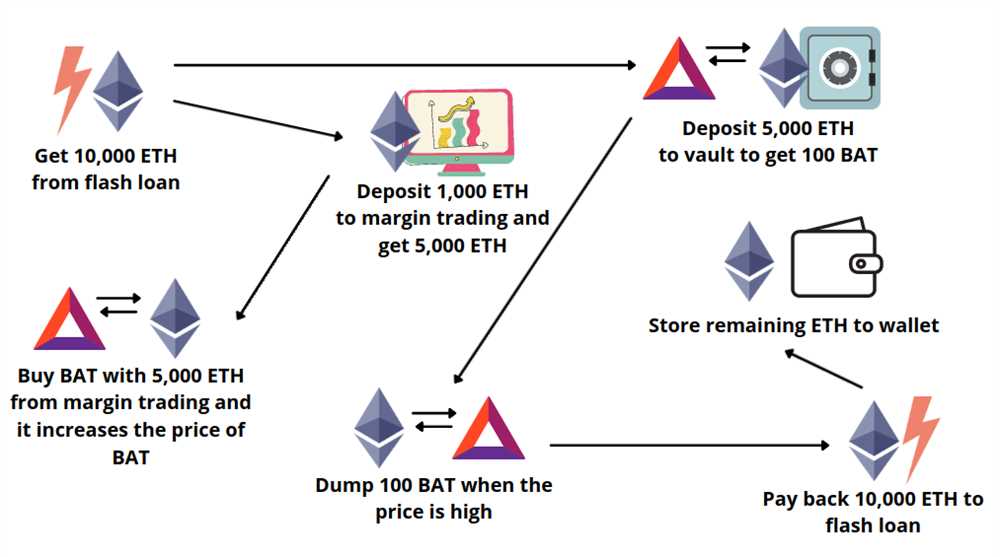

- Arbitrage opportunities: Flash loans enable users to take advantage of price discrepancies and arbitrage opportunities across different decentralized exchanges and protocols. By leveraging large amounts of capital, users can profit from small price differences within a single transaction.

- Risk of transaction failure: Since flash loans need to be repaid within the same transaction, there is a risk of transaction failure if the loan amount cannot be repaid. However, this risk can be minimized by carefully designing and testing the transaction logic.

Use Cases of Flash Loans

Flash loans have opened up a wide range of use cases in DeFi:

| Use Case | Description |

|---|---|

| Arbitrage | Traders can use flash loans to exploit price differences between decentralized exchanges, buying assets from one exchange and selling them at a higher price on another. |

| Liquidation | Flash loans can be used to liquidate undercollateralized loans or positions, allowing users to profit from the liquidation process. |

| Collateral swapping | Borrowers can use flash loans to quickly swap their collateral between different lending platforms, taking advantage of better interest rates or borrowing conditions. |

| Arbitrage trading bots | Automated trading bots can leverage flash loans to perform complex arbitrage strategies in a single transaction, maximizing profits. |

Overall, flash loans have revolutionized the DeFi space by enabling users to access large amounts of capital instantly and without collateral. They have opened up new opportunities for traders, arbitrageurs, and DeFi enthusiasts to generate profits and participate in the decentralized finance ecosystem.

Understanding the Fundamentals of Flash Loans in DeFi

In the world of decentralized finance (DeFi), flash loans have emerged as a powerful tool for users to access liquidity without requiring collateral. This innovative feature has opened up new possibilities for traders, arbitrageurs, and developers in the DeFi ecosystem.

What are Flash Loans?

Flash loans are a type of uncollateralized loan that can be instantly taken and repaid within a single transaction on a blockchain network. They allow users to borrow a certain amount of assets for a short period of time, without the need for any collateral or credit checks. The borrowed assets must be returned within the same transaction, along with the respective fees.

Flash loans are made possible by the smart contract functionality of decentralized platforms like 1inch. These contracts execute a series of pre-defined instructions and verify the necessary conditions before the loan is granted. If the conditions are not met, the loan is automatically reverted and no funds are transferred.

How Do Flash Loans Work?

Flash loans work by taking advantage of the composability and programmability of smart contracts in DeFi. Here’s a step-by-step breakdown of how they work:

- A user initiates a flash loan request by specifying the amount and type of assets they want to borrow.

- The smart contract verifies the user’s request and checks if the necessary conditions are met, such as sufficient liquidity and funds in the lending pool.

- If the conditions are met, the flash loan is approved and the requested assets are transferred to the user’s wallet.

- The user can then utilize the borrowed assets for any desired purpose, such as trading, arbitrage, or liquidity provision.

- Within the same transaction, the user must repay the borrowed assets along with the corresponding fees.

- If the repayment is successful, the flash loan is considered closed.

- If the repayment fails or the user tries to perform any other action without repaying the loan, the entire transaction is automatically reversed, ensuring that no funds are lost.

Flash loans have gained popularity due to their ability to enable complex trading strategies and arbitrage opportunities. Traders can borrow a large amount of assets, execute multiple trades, and return the borrowed assets within the same transaction, all without any upfront capital.

However, it is important to note that flash loans pose certain risks. If the borrowed assets are not repaid within the same transaction, the loan is automatically reversed, which can potentially lead to a loss of funds or collateral for the user. Therefore, proper understanding and careful execution are essential when utilizing flash loans.

The Benefits and Risks of Flash Loans

Flash loans have gained popularity in the decentralized finance (DeFi) space due to their unique benefits and potential for high profitability. However, they also come with their own set of risks that users need to be aware of. In this section, we will explore both the benefits and risks associated with flash loans.

Benefits:

| Benefits | Description |

|---|---|

| Arbitrage Opportunities | Flash loans provide users with the ability to exploit price discrepancies across different decentralized exchanges, allowing for profitable arbitrage opportunities. |

| Faster Access to Capital | Flash loans eliminate the need for traditional collateral and credit checks, allowing users to quickly access large amounts of capital without any upfront investment. |

| Lower Transaction Costs | Flash loans can significantly reduce transaction costs, as they eliminate the need for multiple transactions and fees associated with borrowing and lending. |

| Flexibility | Flash loans provide users with the flexibility to use the borrowed funds for various purposes, including refinancing existing loans, liquidity provision, and funding new projects. |

Risks:

| Risks | Description |

|---|---|

| Market Volatility | Flash loans are highly dependent on market conditions and can be risky during periods of high volatility, as rapid price movements can lead to losses. |

| Smart Contract Vulnerabilities | Flash loans rely on smart contracts, which are susceptible to bugs and vulnerabilities. Users need to be cautious and thoroughly audit the smart contracts they interact with to mitigate the risk of potential hacks or exploits. |

| Impermanent Loss | Flash loans involving liquidity provision can expose users to impermanent loss, a phenomenon where the value of the provided liquidity is lower compared to holding the underlying assets. |

| Network Congestion | During periods of high demand, network congestion can occur, leading to delays in loan execution or higher transaction fees. This can impact the profitability and effectiveness of flash loan strategies. |

It is important for users to thoroughly research and understand the benefits and risks associated with flash loans before engaging in any flash loan transactions. Proper risk management strategies, such as diversification and careful monitoring of market conditions, can help mitigate potential risks and ensure a successful flash loan experience.

Exploring the Advantages and Disadvantages of Flash Loans in DeFi

Flash loans have gained popularity in the decentralized finance (DeFi) space due to their unique features and advantages. However, like any other financial tool, flash loans also have their disadvantages that need to be taken into consideration. In this article, we will explore the advantages and disadvantages of flash loans in DeFi.

Advantages of Flash Loans

1. Instant Access to Liquidity: With flash loans, users can instantly borrow a significant amount of funds without any collateral requirements. This allows for quick and efficient liquidity management, which can be beneficial for various trading and arbitrage strategies.

2. Cost-effective: Flash loans can be cost-effective as borrowers only pay the transaction fees associated with the loan and not any interest charges. This makes them an attractive option for users who want to access large amounts of capital without incurring significant costs.

3. Opportunity for Risk-free Arbitrage: Flash loans empower users to exploit price differences between different decentralized exchanges (DEXs) to make risk-free profits. By borrowing funds, executing the arbitrage trade, and repaying the loan within a single transaction, users can take advantage of temporary market inefficiencies.

Disadvantages of Flash Loans

1. Manipulation and Market Volatility: Flash loans can be used for malicious purposes, such as market manipulation or triggering cascading liquidations. This potential for abuse can lead to increased market volatility and exposes borrowers to the risk of liquidation if the market reacts unfavorably to their actions.

2. Time-sensitive Nature: Flash loans have a time-sensitive nature, requiring borrowers to repay the loan within a single transaction block. Failing to do so will result in the entire transaction being reverted, potentially causing losses for the borrower. This time constraint puts pressure on borrowers to execute their intended strategies quickly and efficiently.

3. Limited Use Cases: Flash loans are primarily useful for specific trading and arbitrage strategies. They may not be suitable for long-term investments or projects that require long-term capital financing. Additionally, flash loans may not offer the same level of functionality or flexibility as traditional loans.

Overall, flash loans offer unique advantages in terms of instant liquidity access and cost-effectiveness, but they also come with their own set of risks and limitations. It is important for users to fully understand these advantages and disadvantages before engaging in flash loan activities in the DeFi space.

How to Use 1inch for Flash Loans

Using 1inch for flash loans is a straightforward process that requires a few steps. Follow the guide below to get started:

Step 1: Connect Your Wallet

The first step is to connect your digital wallet to the 1inch platform. You can connect wallets such as MetaMask, WalletConnect, or Fortmatic. Make sure to choose a secure and trusted wallet provider.

Step 2: Select the Flash Loan Option

Once your wallet is connected, navigate to the 1inch platform and select the flash loan option. This will allow you to access the flash loan features and execute transactions without requiring upfront capital.

Step 3: Choose Your Loan Parameters

After selecting the flash loan option, you will be prompted to choose your loan parameters. This includes the token you want to borrow and the amount you wish to borrow. Make sure to consider the risks involved and choose appropriate loan parameters.

Step 4: Execute Your Flash Loan

Once you have defined your loan parameters, you can proceed to execute your flash loan. 1inch will automatically handle the borrowing and repayment process on your behalf. You can monitor the progress of your flash loan transaction in real-time.

Step 5: Utilize the Borrowed Funds

With the borrowed funds, you can now engage in various DeFi activities such as arbitrage trading, liquidity provision, or other strategies that benefit from temporary capital. Ensure that you have a well-thought-out plan for utilizing the funds effectively.

Step 6: Repay Your Flash Loan

Once you have completed your desired activities with the borrowed funds, you need to repay the flash loan amount within the same transaction. Failure to repay the loan within the specified timeframe will result in the transaction being reverted.

By following these steps, you can make use of 1inch’s flash loan feature to access capital without requiring upfront funding. It is important to understand the risks involved and exercise caution when utilizing flash loans.

Question-answer:

What is a flash loan?

A flash loan is a type of decentralized finance (DeFi) loan that allows users to borrow and repay funds within the same transaction block without requiring collateral.

How does a flash loan work?

A flash loan works by utilizing the composability feature of smart contracts on the Ethereum blockchain. Users can borrow a large amount of funds from a liquidity pool, execute various operations within the same transaction, and then repay the loan along with any fees. If the loan is not repaid within the same transaction, the entire transaction is reversed.

What are the benefits of using flash loans?

Flash loans offer several benefits in decentralized finance. They provide immediate access to a large amount of liquidity without the need for collateral, enabling users to leverage funds for arbitrage opportunities, collateral swaps, and other complex transactions. Flash loans also help improve efficiency and reduce capital requirements in DeFi protocols.

Are there any risks associated with flash loans?

Yes, flash loans carry certain risks. One risk is the possibility of a failed transaction if the loan is not repaid within the same block, resulting in the loss of borrowed funds and any fees paid. Additionally, flash loans can be vulnerable to price manipulation and other attacks, so it is important to carefully analyze the risks and implement appropriate security measures when using flash loans.