Decentralized Finance (DeFi) has emerged as one of the most exciting and disruptive trends in the blockchain industry. With its promise of democratizing financial services and eliminating intermediaries, DeFi has attracted the attention of both retail and institutional investors. Among the many innovative projects in the DeFi space, 1inch has emerged as a leading player.

1inch is a decentralized exchange aggregator that allows users to find and execute the most efficient trades across multiple decentralized exchanges (DEXs). Through its smart routing algorithm, 1inch automatically splits orders and finds the best prices for users, maximizing their returns and minimizing slippage. This makes 1inch a powerful tool for traders looking to optimize their trading strategies in the decentralized ecosystem.

What sets 1inch apart from other decentralized exchanges is its focus on finding the best possible prices for users. Unlike traditional exchanges that rely on a single order book, 1inch aggregates liquidity from multiple DEXs, allowing users to access a larger pool of liquidity and find better prices. By leveraging the power of blockchain technology, 1inch is able to provide users with a seamless and efficient trading experience, without compromising on security and transparency.

As the DeFi ecosystem continues to evolve, so does 1inch. In addition to its exchange aggregation services, 1inch has also expanded into other areas such as lending and yield farming. By offering these additional services, 1inch aims to provide users with a more comprehensive suite of DeFi tools, allowing them to maximize their returns and participate in the growth of the decentralized ecosystem. With its innovative approach and commitment to user-centric design, 1inch is well-positioned to play a key role in shaping the future of DeFi.

The Rise of 1inch in the DeFi Ecosystem

1inch has emerged as one of the leading decentralized finance (DeFi) protocols, offering users a new way to access liquidity across multiple decentralized exchanges (DEXs). Since its launch in 2019, 1inch has made significant strides in the DeFi ecosystem, attracting investors and users alike.

One of the key features that has contributed to the rise of 1inch is its innovative and unique approach to liquidity aggregation. By leveraging smart contracts and an intelligent routing algorithm, 1inch is able to split a user’s order across multiple DEXs to ensure the best possible price for their trade. This has made 1inch a go-to platform for traders looking to optimize their trading strategies and reduce slippage.

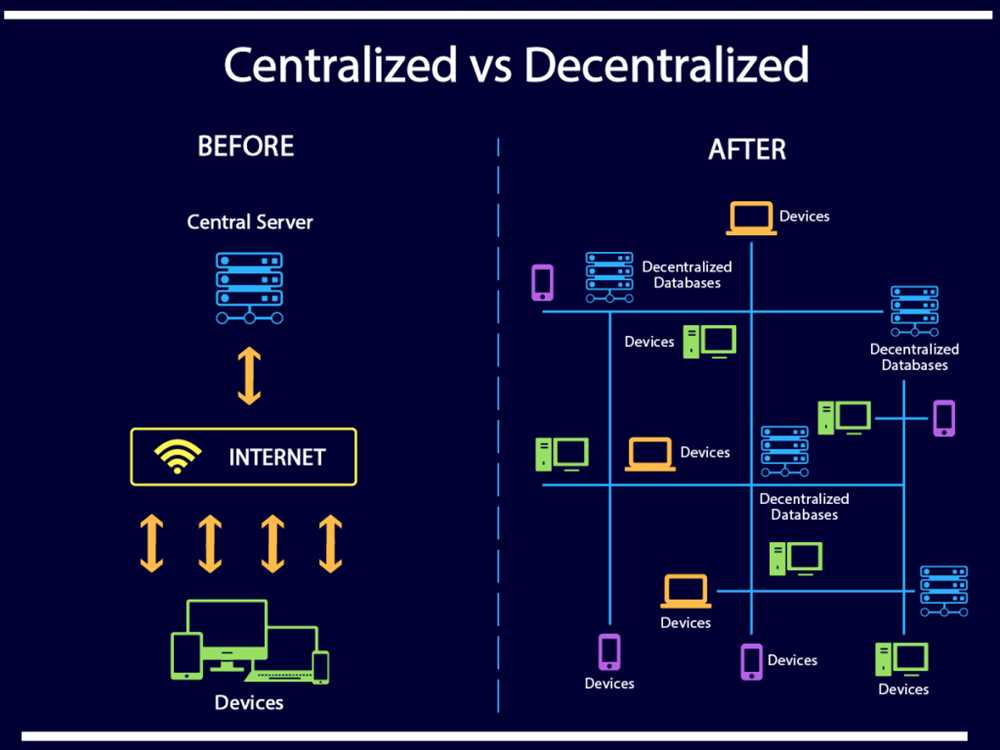

Another factor that has contributed to the success of 1inch is its commitment to decentralization and transparency. Unlike traditional centralized exchanges, 1inch does not hold user funds or require users to create an account. Instead, users connect their wallets directly to the platform, allowing them to retain control of their funds at all times. This approach has resonated with the DeFi community, who value the principles of self-custody and privacy.

Additionally, 1inch has been quick to adapt and embrace new trends and protocols within the DeFi ecosystem. For example, it was one of the first platforms to integrate with yield farming protocols, allowing users to earn additional income by providing liquidity. This integration helped 1inch gain even more traction and attract new users who were interested in earning passive income.

Lastly, 1inch’s strong community and active development team have played a crucial role in its rise within the DeFi ecosystem. The platform has a dedicated community of users and developers who constantly contribute to its growth and improvement. This has resulted in regular updates and new features being added to the platform, further enhancing the user experience.

In conclusion, 1inch has quickly risen to prominence within the DeFi ecosystem due to its innovative liquidity aggregation, commitment to decentralization, adaptability, and strong community. As the DeFi landscape continues to evolve, 1inch is well-positioned to further cement its place as a leading protocol.

The Emergence of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has emerged as one of the most innovative and disruptive sectors in the cryptocurrency industry. It refers to the use of blockchain technology and smart contracts to recreate and enhance traditional financial systems in a decentralized, transparent, and permissionless manner.

DeFi aims to provide open and accessible financial services to anyone with an internet connection, bypassing the need for intermediaries such as banks or other centralized financial institutions. This allows for greater financial inclusion, lower costs, and improved efficiency.

One of the key principles of DeFi is composability, which refers to the ability of different protocols and applications to seamlessly interact with each other. This means that users can leverage various decentralized applications (dApps) and protocols to engage in a wide range of financial activities such as lending, borrowing, trading, and earning interest.

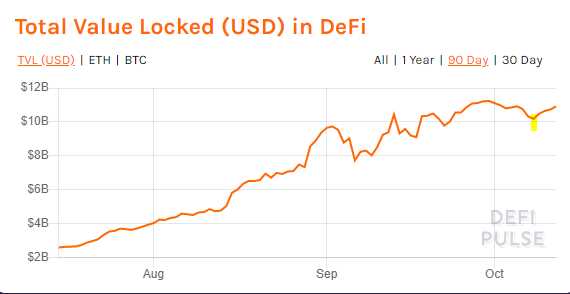

The Growth of DeFi

The growth of DeFi has been staggering since its inception. In 2020, the total value locked (TVL) in DeFi protocols surpassed $1 billion, and by mid-2021, it had skyrocketed to over $80 billion. This exponential growth can be attributed to several factors:

- Technology Advancements: The development of blockchain technology and smart contracts has laid the foundation for DeFi’s growth. These technological advancements have made it possible to create secure, transparent, and programmable financial systems.

- Financial Inclusion: DeFi has the potential to provide financial services to the unbanked and underbanked populations around the world. It allows individuals to access loans, savings, and investments without relying on traditional financial intermediaries.

- Interoperability: The interoperability of different DeFi protocols and applications has led to the creation of a vibrant ecosystem where users can seamlessly move their assets and liquidity across various platforms.

- Yield Farming: Yield farming has emerged as a popular activity in DeFi, enabling users to earn high yields by providing liquidity to decentralized exchanges (DEXs) or lending platforms. This has attracted a significant amount of capital to the DeFi space.

The Future of DeFi

The future of DeFi looks promising, with the potential to revolutionize traditional financial systems and democratize access to financial services on a global scale. However, there are also challenges that need to be addressed, such as scalability, security, and regulatory compliance.

As the DeFi ecosystem evolves, we can expect to see further innovation, integration with traditional finance, and increased adoption by both retail and institutional investors. The emergence of protocols like 1inch, which enable users to access the best prices and liquidity across multiple decentralized exchanges, showcases the potential of DeFi and its ability to disrupt the traditional financial landscape.

1inch’s Unique Features and Advantages

1inch is a decentralized exchange aggregator that has gained popularity in the DeFi ecosystem. It stands out from other exchanges due to its unique features and advantages:

1. Aggregation of Liquidity: 1inch combines liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates for their trades. This allows traders to access a larger pool of liquidity and potentially get better prices.

2. Optimized Gas Fees: 1inch has implemented a GasToken mechanism that reduces the cost of gas fees for users. By optimizing gas usage, 1inch minimizes transaction costs and provides a more cost-effective trading experience.

3. Pathfinding Algorithm: 1inch employs a sophisticated Pathfinder algorithm that scans various DEXs to find the most efficient trading route. This algorithm takes into account factors such as gas fees, slippage, and liquidity to ensure users get the best possible outcome for their trades.

4. Smart Contract Integration: 1inch integrates with other DeFi protocols and platforms through its smart contracts, allowing users to access a wide range of DeFi services and features directly from the 1inch platform. This seamless integration enhances the usability and convenience of the platform.

5. Governance and Tokenomics: 1inch has its native governance token, 1INCH, which serves various functions within the ecosystem. Holders of the 1INCH token can participate in the governance of the protocol, earn rewards, and receive discounts on trading fees. This tokenomics model incentivizes participation and contributes to the overall sustainability and growth of the platform.

6. Security and Trustworthiness: 1inch places a strong emphasis on security and users’ trust. It has undergone thorough audits by reputable security firms and implements various security measures to protect users’ funds and data. Additionally, the protocol is decentralized, ensuring that it remains resilient and immune to single points of failure.

7. User-friendly Interface: 1inch provides a user-friendly interface that is easy to navigate, making it accessible to both experienced and novice users. The platform offers a straightforward and intuitive trading experience, allowing users to execute trades quickly and efficiently.

Overall, 1inch’s unique features and advantages make it a preferred choice for many traders and participants in the DeFi ecosystem. Its focus on liquidity aggregation, optimized gas fees, smart contract integration, and strong security measures contribute to its success and popularity among users.

The Future of 1inch and DeFi

The rapid growth of the decentralized finance (DeFi) ecosystem has created new opportunities and challenges for projects like 1inch. As the DeFi landscape continues to evolve, the future of 1inch holds great potential for innovation and expansion.

1. Expanding into New Markets

With its agnostic and versatile platform, 1inch is uniquely positioned to expand into new markets beyond its current focus on Ethereum. As other blockchain networks gain traction in the DeFi space, 1inch has the opportunity to integrate with these networks, providing users with access to a broader range of assets and liquidity pools.

2. Scaling and Improving User Experience

As the user base of DeFi projects like 1inch continues to grow, scalability and user experience become critical factors for success. 1inch is actively exploring layer 2 solutions and other scaling technologies to ensure that its platform can handle increasing demand while maintaining low transaction fees and fast execution times. Improving the user experience through intuitive interfaces and advanced features will also be a key focus for 1inch.

3. Enhanced Security and Auditing

As the DeFi ecosystem matures, security and auditing become paramount for user trust and platform reliability. 1inch will continue to prioritize the implementation of rigorous security measures and auditing practices to protect user funds and ensure the integrity of its platform. Collaboration with leading security firms and regular security audits will be crucial in this regard.

To maintain its leading position in the DeFi ecosystem, 1inch must stay at the forefront of technology and innovation. By expanding into new markets, scaling its platform, improving user experience, and enhancing security and auditing practices, 1inch is well-positioned to shape the future of DeFi and continue providing value to its users.

Question-answer:

What is 1inch and how does it relate to the DeFi ecosystem?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to offer users the best possible trading rates. It helps DeFi users find the most efficient routes for their trades and optimizes gas fees. It plays a crucial role in the DeFi ecosystem by improving overall user experience and making trading more efficient.

How does 1inch ensure the security of user funds?

1inch uses smart contract technology to enable secure peer-to-peer trades. It does not hold users’ funds, and all trades are executed directly on the blockchain. Smart contracts are audited and thoroughly tested to minimize the risk of vulnerabilities. Additionally, 1inch has a bug bounty program to incentivize security researchers to identify and report any potential vulnerabilities.

What are the advantages of using 1inch over centralized exchanges?

There are several advantages of using 1inch over centralized exchanges. Firstly, 1inch offers the best possible trading rates by sourcing liquidity from multiple exchanges, which can result in better prices for users. Secondly, 1inch is decentralized, meaning users have full control over their funds and trades are executed peer-to-peer without the need for intermediaries. Lastly, 1inch is non-custodial, which eliminates the risk of hacks or thefts associated with centralized exchanges.