Discover the Advanced Tools of 1inchswap

Looking to trade cryptocurrencies? It’s crucial to have the right tools at your disposal to mitigate risks and maximize your profits. When it comes to crypto trading, 1inchswap is the platform you can trust.

With 1inchswap’s advanced tools, you can stay ahead of the market and make informed trading decisions. Our platform offers a powerful combination of security, speed, and convenience, making it the go-to choice for experienced traders and newcomers alike.

Take advantage of our cutting-edge features:

- Smart Contract Protection: Our advanced security measures protect your funds from unauthorized access and ensure the integrity of your transactions.

- Liquidity Protocol: Seamlessly swap between cryptocurrencies with competitive prices and low slippage, thanks to our liquidity aggregation algorithm.

- Portfolio Tracking: Track your investments and analyze your performance to make strategic decisions and optimize your trading strategy.

- Decentralized Governance: Participate in the decision-making process of the platform through community voting and contribute to shaping the future of crypto trading.

Don’t let risks hold you back! With 1inchswap, you can trade with confidence and peace of mind. Join thousands of successful traders and experience the power of our advanced tools today.

Mitigating Risks in Crypto Trading

Crypto trading can be an exciting and potentially lucrative venture, but it also comes with its fair share of risks. However, with the advanced tools provided by 1inchswap, you can take steps to mitigate these risks and trade with confidence.

One of the key risks in crypto trading is the volatility of the market. Prices can fluctuate wildly in a short period of time, making it challenging to predict the direction of the market. 1inchswap’s tools provide you with real-time data and analysis, allowing you to make informed decisions based on the latest market trends.

Another risk in crypto trading is the potential for security breaches. Hackers and scammers are constantly on the lookout for vulnerabilities in the system, and if they manage to gain access to your funds, it can be devastating. However, 1inchswap has implemented robust security measures to ensure the safety of your assets. They use advanced encryption techniques and incorporate multi-factor authentication to protect your account.

One of the biggest risks in crypto trading is the lack of liquidity. Some assets may have low trading volumes, which can make it difficult to buy or sell at your desired price. This can lead to slippage, where you end up paying more or receiving less than expected. 1inchswap’s liquidity pools solve this problem by aggregating liquidity from multiple sources, ensuring that you can always find the best prices for your trades.

Finally, there is the risk of making poor investment decisions due to lack of information. With so many cryptocurrencies and tokens available, it can be overwhelming to research each one individually. However, 1inchswap provides comprehensive information and analysis on a wide range of assets, helping you make well-informed investment choices.

In conclusion, trading crypto comes with its fair share of risks, but with 1inchswap’s advanced tools, you can mitigate these risks and trade with confidence. Their real-time data, robust security measures, liquidity pools, and comprehensive information will empower you to make informed decisions and navigate the crypto market successfully.

inchswap’s Advanced Tools

1inchswap offers a range of advanced tools to help mitigate risks in crypto trading. These tools are designed to provide users with the necessary information and functionality to make informed trading decisions and optimize their trading strategies.

Smart Contract Analyzer: With inchswap’s Smart Contract Analyzer, users can easily analyze the security and reliability of smart contracts before executing a trade. This tool scans the code of the smart contract and identifies potential vulnerabilities or risks, allowing users to make an informed decision about whether to proceed with the trade.

Slippage Checker: Trading in the volatile crypto market can be risky due to price slippage. With inchswap’s Slippage Checker, users can identify the potential slippage for a specific trade and adjust their settings accordingly. This tool helps users to avoid unexpected losses and ensures their trades are executed at the desired price.

Gas Fee Estimator: Gas fees can significantly impact the profitability of crypto trades. With inchswap’s Gas Fee Estimator, users can estimate the gas fees for a specific trade on different blockchain networks. This tool helps users to optimize their trading strategies by choosing the blockchain network with the most favorable gas fees.

Liquidity Aggregator: Liquidity is crucial for efficient trading. inchswap’s Liquidity Aggregator combines liquidity from various decentralized exchanges (DEXs) to ensure users get the best possible prices for their trades. This tool helps users to access deep liquidity pools and avoid excessive slippage.

By utilizing inchswap’s advanced tools, crypto traders can enhance their trading experience and minimize risks. These tools are designed to empower users with the necessary information and functionality to make informed trading decisions, ultimately leading to more successful and profitable trades.

Why Risk Management Matters

When it comes to crypto trading, risk management is of utmost importance. The volatile nature of the cryptocurrency market makes it crucial for traders to have effective risk management strategies in place. Without proper risk management, traders expose themselves to significant financial losses and potentially devastating consequences.

One of the main reasons why risk management matters in crypto trading is the unpredictability of the market. The prices of cryptocurrencies can fluctuate dramatically within a short period of time, leading to potential gains or losses. By implementing risk management strategies, traders can minimize their exposure to these volatile price swings and protect their capital.

Protecting Against Market Volatility

Market volatility is a common characteristic of cryptocurrencies. The prices of cryptocurrencies can be influenced by various factors, such as regulatory changes, market sentiment, and technological advancements. Risk management enables traders to mitigate the impact of market volatility by diversifying their investment portfolio, setting stop-loss orders, and using other risk mitigation tools.

Preserving Capital

Preserving capital is another key aspect of risk management in crypto trading. By managing risk effectively, traders can protect their capital and avoid significant losses. This can be achieved by setting appropriate risk-reward ratios, using trailing stop orders, and implementing other risk management techniques.

Emotional Discipline and Rational Decision Making

Risk management also plays a vital role in maintaining emotional discipline and making rational trading decisions. Emotional discipline is important in crypto trading because emotions can cloud judgment and lead to impulsive decisions. By having a risk management plan, traders are more likely to stay disciplined and make rational trading decisions based on well-defined rules and strategies.

In conclusion, risk management is a critical aspect of successful crypto trading. By implementing effective risk management strategies, traders can protect themselves from the unpredictable nature of the market, preserve their capital, and make rational trading decisions. Without proper risk management, traders expose themselves to unnecessary risks and potential financial ruin.

Key Features of 1inchswap’s Tools

1. Advanced Trading Algorithms: 1inchswap’s tools utilize sophisticated algorithms to analyze market conditions and execute trades with the highest level of efficiency. These algorithms consider various factors such as liquidity, price volatility, and order book depth to provide traders with the best possible trading opportunities.

2. Smart Contract Integration: By leveraging smart contract technology, 1inchswap’s tools ensure secure and transparent transactions. Smart contracts automatically execute trades based on predetermined conditions, eliminating the need for intermediaries and reducing the potential for fraud or manipulation.

3. Fast and Reliable Execution: 1inchswap’s tools are designed to provide fast and reliable execution, even during periods of high market volatility. With low slippage and minimal transaction fees, traders can efficiently manage their trades and take advantage of market movements to maximize their profits.

4. Wide Range of Supported Tokens: 1inchswap supports a wide range of tokens, allowing traders to access a diverse selection of trading opportunities. Whether you’re looking to trade popular cryptocurrencies or explore emerging altcoins, 1inchswap’s tools provide access to a comprehensive token ecosystem.

5. User-Friendly Interface: 1inchswap’s tools feature a user-friendly interface that is intuitive and easy to navigate. Whether you’re a beginner or an experienced trader, you can quickly customize your trading preferences, monitor your portfolio, and execute trades with ease.

6. Aggregated Liquidity: 1inchswap’s tools aggregate liquidity from various decentralized exchanges, ensuring that traders have access to the best possible prices. By pooling liquidity from multiple sources, 1inchswap minimizes slippage and maximizes trading opportunities for its users.

7. Transparent and Decentralized: 1inchswap’s tools operate on a decentralized network, ensuring transparency and eliminating the need for trust in centralized intermediaries. Users retain full control of their funds, and transactions can be verified on the blockchain, providing an additional layer of security and accountability.

8. Advanced Security Measures: 1inchswap prioritizes the security of its users’ funds and employs advanced security measures to safeguard against any potential threats. These measures include multi-signature wallets, cold storage, and regular security audits to ensure the highest level of protection for users’ assets.

9. Automated Portfolio Management: 1inchswap’s tools offer automated portfolio management features, allowing users to set predefined trading strategies and execute trades automatically based on specific parameters. This saves time and effort, enabling traders to capitalize on market opportunities without constantly monitoring the market.

10. Continuous Innovation: 1inchswap is committed to continuous innovation and development, regularly introducing new features and enhancements to its tools. By staying at the forefront of industry trends and adopting new technologies, 1inchswap ensures that its users have access to the most advanced and cutting-edge trading tools.

How to Leverage 1inchswap for Risk Mitigation

When it comes to crypto trading, one of the biggest concerns for investors is the potential risks involved. However, with 1inchswap’s advanced tools, you can mitigate these risks and trade with confidence.

1. Diversify your Portfolio

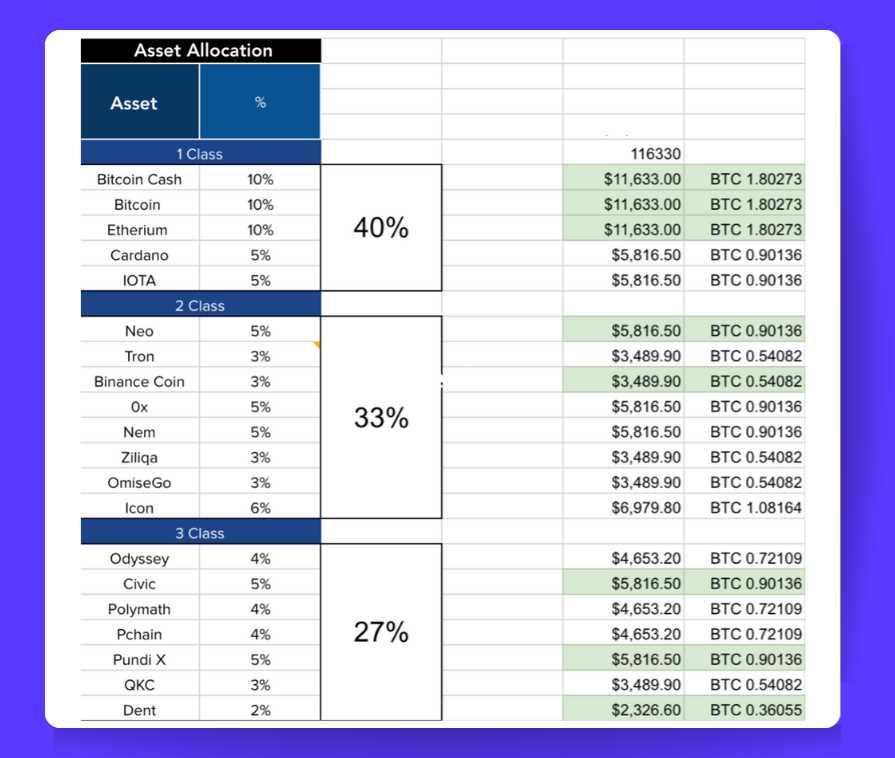

One of the fundamental strategies for risk mitigation is diversification. By spreading your investments across different cryptocurrencies, you can reduce the impact of any single asset’s performance on your overall portfolio.

With 1inchswap, you have access to a wide range of cryptocurrencies and tokens. You can easily diversify your portfolio by swapping between different assets, ensuring that you are not overly exposed to any one particular cryptocurrency.

2. Take Advantage of Advanced Tools

1inchswap offers a variety of advanced tools to help you manage and mitigate risk. One such tool is the slippage tolerance feature, which allows you to set a maximum deviation from the expected price when making a trade.

By setting a slippage tolerance, you can protect yourself from sudden price fluctuations and ensure that you are getting the best possible price for your trades.

Additionally, 1inchswap’s gas optimization feature helps you reduce transaction costs by finding the most cost-effective way to execute your trades. This not only saves you money but also minimizes the impact of transaction fees on your overall trading strategy.

3. Stay Informed with Real-Time Data

Another crucial aspect of risk mitigation is staying informed about market trends and price movements. 1inchswap provides real-time data and price charts for all the cryptocurrencies available on the platform.

By keeping a close eye on the market, you can make informed decisions and adjust your trading strategy accordingly. 1inchswap’s real-time data allows you to stay ahead of the market and react quickly to any changing conditions or emerging opportunities.

In conclusion, leveraging 1inchswap’s advanced tools for risk mitigation in crypto trading is essential. By diversifying your portfolio, taking advantage of advanced tools, and staying informed with real-time data, you can optimize your trading strategy and minimize potential risks.

Note: Crypto trading involves inherent risks, and it is important to conduct thorough research and seek professional advice before making any investment decisions.

Question-answer:

What are the main risks in crypto trading?

The main risks in crypto trading include market volatility, security vulnerabilities, and the potential for scams or fraudulent activities.

How does 1inchswap help mitigate these risks?

1inchswap offers advanced tools such as limit orders and stop-loss orders to help traders minimize the impact of market volatility. The platform also prioritizes security measures to protect user funds and provides access to a wide range of reputable and vetted tokens.

Are there any fees associated with using 1inchswap’s advanced tools?

Yes, there are fees associated with using 1inchswap’s advanced tools. The fees vary depending on the specific tool being used and the size of the trade.

Can beginners use 1inchswap’s advanced tools?

Yes, beginners can use 1inchswap’s advanced tools. The platform is designed to be user-friendly and provides guidance and tutorials for new users. However, it is important for beginners to understand the risks involved in crypto trading and to start with smaller trades before progressing to larger ones.

Can I trust 1inchswap with my funds and personal information?

Yes, 1inchswap has established a solid reputation in the crypto community and takes extensive security measures to protect user funds and personal information. However, it is always recommended to take additional precautions such as enabling two-factor authentication and keeping your login credentials secure.