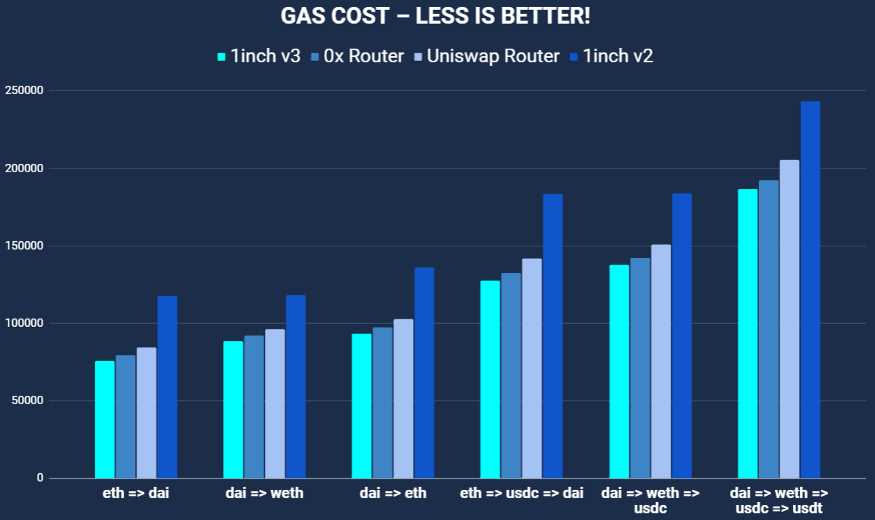

1inch is a decentralized exchange aggregator that allows users to find the best possible trading prices across multiple liquidity sources. The project has gained significant popularity in the decentralized finance (DeFi) space due to its innovative technology and efficient routing algorithms.

Tokenomics plays a vital role in the success of any DeFi project, and 1inch is no exception. The native token of the 1inch platform is called 1INCH and has several key roles within the ecosystem. Firstly, 1INCH is used as a governance token, allowing holders to participate in the decision-making process of the platform.

Furthermore, 1INCH holders are eligible to receive rewards through yield farming. By staking their tokens, users can earn additional 1INCH tokens as an incentive for providing liquidity to the platform. This mechanism not only encourages users to actively participate in the ecosystem but also helps to ensure a healthy level of liquidity for seamless trading on 1inch.

Another interesting aspect of 1inch’s tokenomics is its buyback and burn mechanism. A portion of the fees generated on the platform is used to buy back 1INCH tokens from the open market. These tokens are then permanently removed from circulation, reducing the total supply and potentially increasing the value of the remaining tokens.

In conclusion, the tokenomics of 1inch are carefully designed to incentivize active participation, provide governance rights, and potentially increase the value of the 1INCH token. As the platform continues to grow and evolve, it will be fascinating to see how these tokenomics mechanisms contribute to its long-term success.

Token Distribution and Issuance

The token distribution and issuance of 1inch follows a comprehensive plan that ensures a fair and transparent allocation of tokens. Here is an overview of how the tokens are distributed and issued:

Initial Token Distribution

1inch initially distributed tokens through several methods:

- Airdrops: A portion of the tokens were allocated to early supporters and community members through airdrops. This helped in decentralizing the ownership and increasing community engagement.

- Private Sale: A private sale was held to raise funds for the development and growth of the 1inch platform. Qualified investors participated in this sale, which allowed for a strategic distribution of tokens.

- Liquidity Mining: To incentivize liquidity provision on the 1inch platform, a liquidity mining program was launched. Participants were able to earn tokens by supplying liquidity to various pools.

- Protocol Reserve: A portion of the tokens was reserved for the long-term sustainability of the protocol. These tokens are held in a reserve and are used to support ecosystem development and foster growth.

Token Issuance

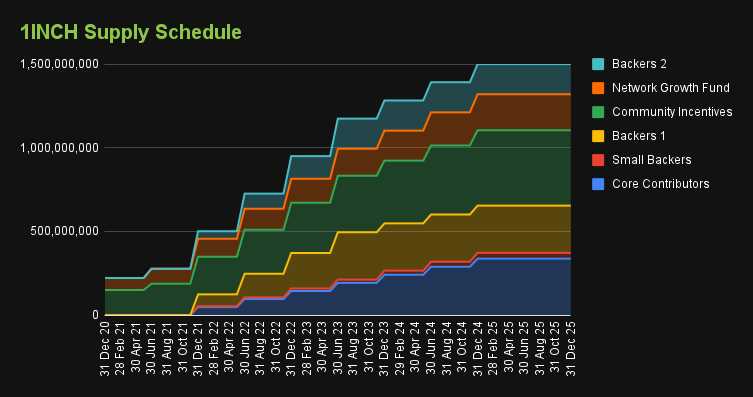

1inch has implemented a well-designed token issuance schedule to ensure a controlled and gradual release of tokens into circulation:

- Initial Distribution: A significant proportion of tokens were distributed during the initial token distribution to ensure a fair and widespread ownership of the tokens.

- Release Schedule: The remaining tokens are released gradually over time to prevent any sudden fluctuations in the token supply. This approach helps to maintain token stability and market equilibrium.

- Vesting: Some tokens allocated to team members and advisors are subject to vesting schedules. This ensures that these tokens are released gradually over a predefined period, preventing any large-scale sell-offs that could negatively impact the token price.

Overall, the token distribution and issuance strategy of 1inch aims to promote decentralization, community involvement, and stability in the token economy. By carefully managing the distribution and release of tokens, 1inch seeks to create a fair and sustainable ecosystem for users and stakeholders.

Token Utilities and Governance

1inch token (1INCH) serves a pivotal role within the 1inch Network and has several utilities and governance features.

The 1INCH token is primarily used for participating in various activities within the 1inch ecosystem, including:

- Protocol governance: 1INCH holders have voting rights and can participate in on-chain governance proposals, allowing them to shape the future of the protocol.

- Platform utility: 1INCH token holders can use their tokens to access certain features and benefits within the 1inch dApp, such as lower trading fees, premium offers, and exclusive rewards.

- Staking and farming: 1INCH tokens can be staked or used in liquidity pools to earn rewards. Stakers and farmers can earn additional 1INCH tokens and other tokens as incentives, further incentivizing participation in the ecosystem.

- Liquidity mining: 1INCH holders can provide liquidity to specific pools and earn additional 1INCH tokens as a reward. This helps ensure sufficient liquidity across various trading pairs on the 1inch platform.

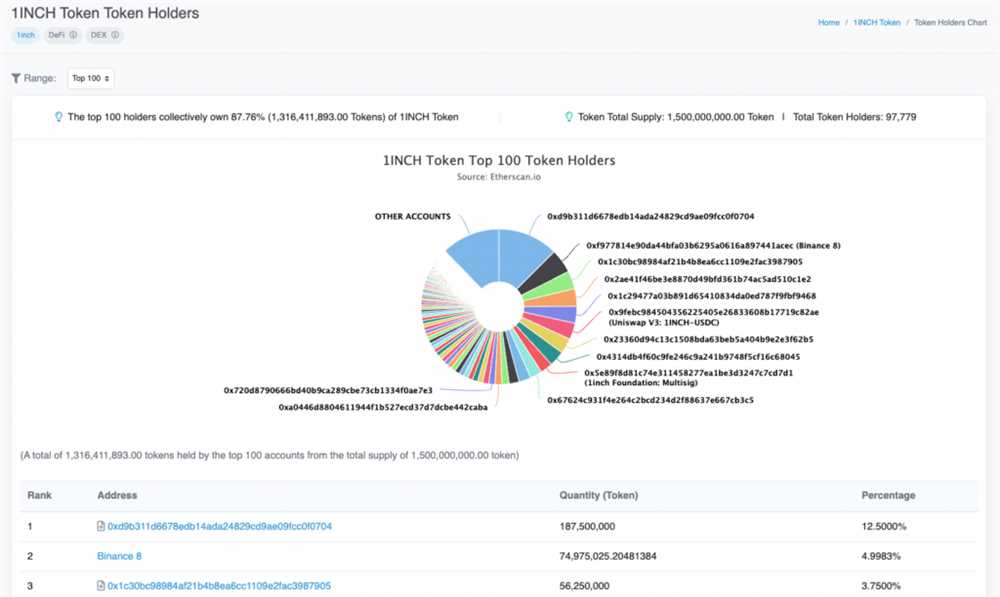

The 1INCH token has a finite supply of 1.5 billion tokens, with a portion of the supply allocated for community incentives, ecosystem development, and team vesting. The token was initially distributed through an airdrop to users of the 1inch exchange and liquidity protocol, ensuring broad distribution and decentralization.

Through its utilities and governance features, the 1INCH token empowers its holders to actively participate in shaping the protocol’s future, access exclusive benefits, and earn rewards for their contributions to the ecosystem. This strong tokenomics design promotes decentralization, incentivization, and community engagement within the 1inch Network.

Note: Token holders should familiarize themselves with the specific rules and mechanisms governing the use and governance of the 1INCH token by referring to the official documentation provided by the 1inch team.

Token Economics and Future Outlook

1inch is built on the Ethereum blockchain and its native token, also called 1INCH, plays a crucial role in the platform’s tokenomics. The total supply of 1INCH is capped at 1.5 billion tokens, with 60% allocated for the community and 40% reserved for the team and advisors.

As a utility token, 1INCH has several use cases within the 1inch ecosystem. Holders of 1INCH can participate in governance by staking their tokens and voting on proposals. They can also use their tokens to pay for transaction fees and receive discounts on fees when using the 1inch platform.

Looking ahead, the future outlook for 1inch and its token is promising. The platform has experienced significant growth since its launch and has established itself as a leading decentralized exchange aggregator. With its user-friendly interface and competitive rates, 1inch is well-positioned to capture a larger market share in the decentralized finance space.

In addition, the team behind 1inch is actively working on expanding the platform’s capabilities and integrating with other blockchains beyond Ethereum. This will allow users to access a wider range of liquidity and trading options, further enhancing the value proposition of 1INCH tokens.

Furthermore, as the decentralized finance ecosystem continues to grow, there will be an increasing demand for efficient and user-friendly platforms like 1inch. This demand, coupled with the limited supply of 1INCH tokens, has the potential to drive up the value of the token over time.

In conclusion, 1inch and its native token, 1INCH, have a strong tokenomics model and an optimistic future outlook. With its growing user base and expanding capabilities, 1inch is well-positioned to become a key player in the decentralized finance industry.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that connects several decentralized exchanges (DEXs) to provide users with the best possible trading rates.

What is tokenomics?

Tokenomics refers to the economics of a token, including its distribution, supply, demand, and utility within a particular ecosystem.

How does 1inch token work?

The 1inch token is used for governance and utility purposes within the 1inch ecosystem. Holders of the 1inch token can participate in community voting and receive rewards for staking their tokens.

What is the purpose of the 1inch token?

The purpose of the 1inch token is to align the incentives of the platform’s users and stakeholders by providing them with governance rights and rewards.

How is the 1inch token distributed?

The 1inch token was initially distributed through an airdrop to early users of the 1inch platform. Additional token distribution is done through liquidity mining, staking rewards, and partnerships.