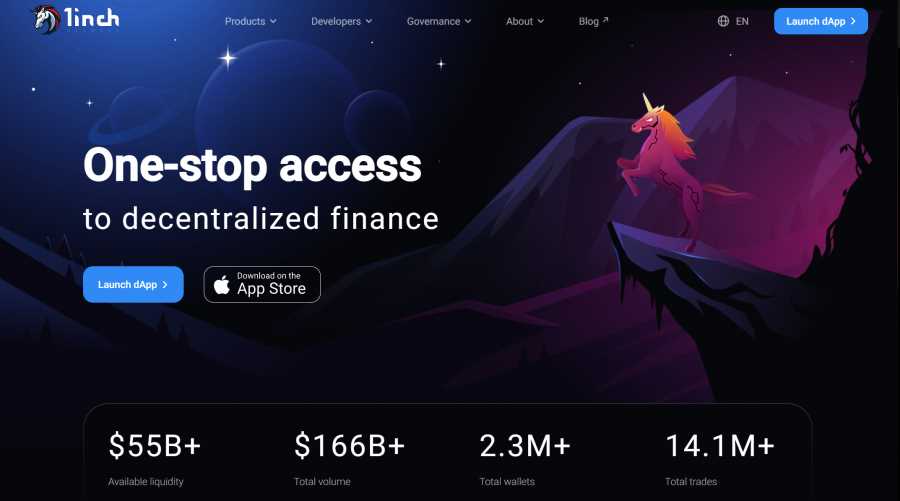

If you’re new to the world of cryptocurrencies, you may have heard about 1inch tokens. 1inch is a decentralized exchange aggregator that allows users to find the best prices across multiple exchanges. The 1inch token, also known as 1INCH, is the native cryptocurrency of the 1inch platform.

If you’re interested in buying 1INCH tokens, this beginner’s guide will take you through the steps you need to follow. Before you start, it’s important to note that buying cryptocurrencies involves risks, and you should only invest what you can afford to lose.

The first step to buying 1INCH tokens is to set up a cryptocurrency wallet. A wallet is like a digital bank account where you can store, send, and receive cryptocurrencies. There are many different wallets available, so make sure to choose a reputable one that supports 1INCH tokens. Some popular options include MetaMask, Trust Wallet, and Ledger.

Once you have your wallet set up, you’ll need to choose a cryptocurrency exchange where you can buy 1INCH tokens. An exchange is a platform that allows you to trade cryptocurrencies for other digital assets or fiat currencies. Some popular exchanges that list 1INCH tokens include Binance, Coinbase, and Kraken. Compare the fees, liquidity, and security features of different exchanges to make an informed decision.

After you’ve chosen an exchange, you’ll need to create an account and complete the verification process. This usually involves providing some personal information and submitting documents to prove your identity. Once your account is verified, you can deposit funds into your exchange account. Most exchanges accept deposits in cryptocurrencies or fiat currencies, so choose the option that works best for you.

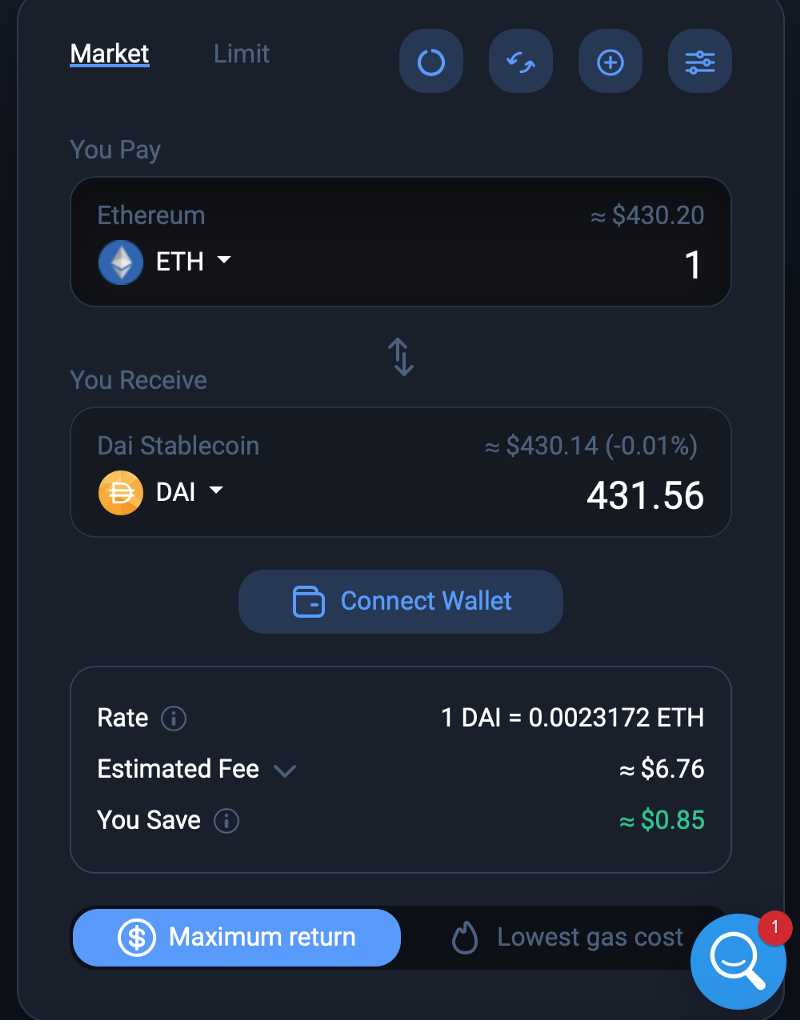

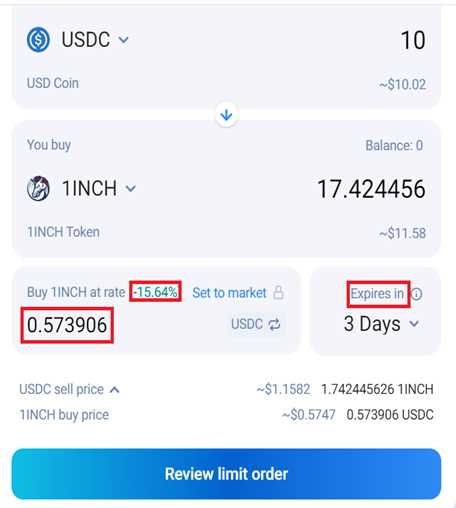

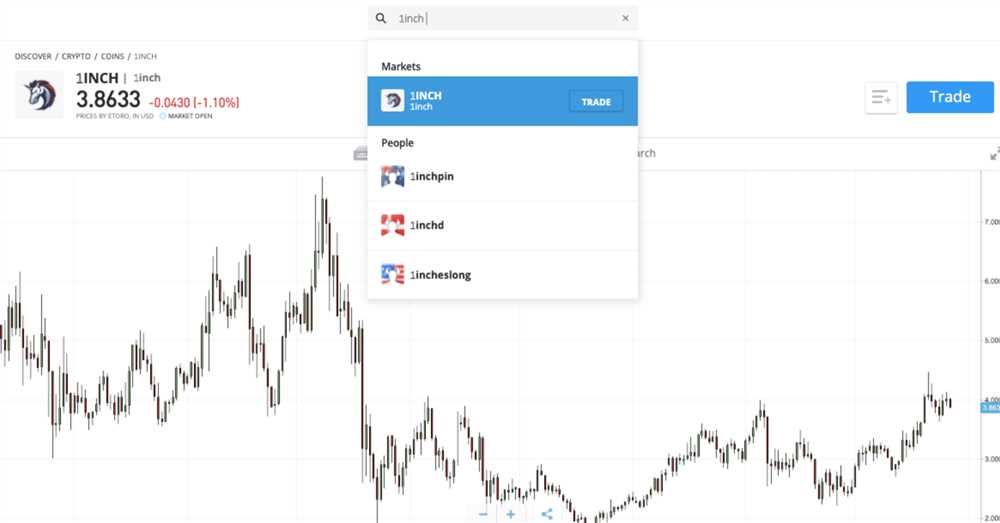

With funds in your exchange account, you’re ready to buy 1INCH tokens. Look for the trading pair that matches 1INCH with your desired currency, such as 1INCH/USD or 1INCH/BTC. Enter the amount of 1INCH tokens you want to buy and review the transaction details. Double-check that you’re buying at the current market price and that the fees are acceptable.

Once you’re satisfied with the details, confirm the transaction and wait for the order to be executed. Depending on market conditions and network congestion, it may take some time for your order to be processed. Once the transaction is complete, you’ll see the 1INCH tokens in your exchange account. You can then choose to keep them in your exchange wallet or transfer them to your personal cryptocurrency wallet for added security.

Remember, buying and trading cryptocurrencies can be complex, and it’s important to do your own research and seek advice from professionals if needed. Make sure to keep your wallet and exchange account secure by using strong passwords, enabling two-factor authentication, and staying vigilant against phishing attempts. Happy buying!

What are 1inch tokens and why you should buy them?

1inch tokens are the native cryptocurrency of the 1inch Network, a decentralized exchange (DEX) aggregator. The 1inch Network searches multiple DEXs and liquidity pools to find the best possible trading routes, ensuring users get the most competitive prices and lowest slippage.

There are several reasons why you should consider buying 1inch tokens:

1. Governance and Voting Rights

By owning 1inch tokens, you become a part of the 1inch Network’s governance system. Token holders can propose and vote on various changes and updates related to the protocol, such as introducing new features, modifying fee structures, or adding supported DEXs. Your input can directly influence the direction and development of the network.

2. Reward Distribution

1inch tokens also entitle you to a share of the network’s rewards. These rewards come from various sources, such as trading fees, protocol fees, and liquidity mining programs. By holding 1inch tokens, you can passively earn additional tokens or other rewards, depending on the platform’s incentive programs.

Additionally, as the network grows and attracts more users, the demand for 1inch tokens can increase, potentially leading to price appreciation. This means that investing in 1inch tokens can also be a way to generate a return on your investment.

Overall, 1inch tokens offer both utility and potential value appreciation, making them an attractive option for users looking to participate in the 1inch Network and potentially benefit from its growth and success.

Key benefits of investing in 1inch tokens

Investing in 1inch tokens offers several key benefits for traders and investors looking to participate in the decentralized finance (DeFi) space. These benefits include:

| 1. Decentralized Exchange (DEX) Aggregator | 1inch is a decentralized exchange aggregator that sources liquidity from various DEX platforms, including Uniswap, Sushiswap, and more. By investing in 1inch tokens, investors can benefit from the growing popularity and usage of decentralized exchanges. |

| 2. Lower Slippage and Better Rates | 1inch’s aggregation algorithm ensures that users get the best rates and lowest slippage when trading on decentralized exchanges. Investing in 1inch tokens allows investors to benefit from the platform’s technology and potentially earn higher profits. |

| 3. Governance Rights | 1inch token holders have governance rights within the 1inch ecosystem. They can vote on proposals and decisions that impact the development and future of the platform. By investing in 1inch tokens, investors can have a say in the direction of the project. |

| 4. Staking and Rewards | 1inch offers staking opportunities for its token holders. By staking 1inch tokens, investors can earn additional rewards in the form of trading fee discounts and distribution of governance tokens from partner protocols. |

| 5. Potential for Future Growth | As the decentralized finance space continues to grow, the demand for decentralized exchange aggregators like 1inch is expected to increase. By investing in 1inch tokens, investors can potentially benefit from the platform’s future growth and increased usage. |

Overall, investing in 1inch tokens provides investors with exposure to the decentralized finance market and the potential for earning profits through the platform’s various features and benefits.

Factors to consider before buying 1inch tokens

1inch is a decentralized exchange aggregator that aims to provide the best prices and lowest fees for users. Before buying 1inch tokens, it is important to consider several factors:

1. Token Utility: Understand the utility of 1inch tokens within the ecosystem. These tokens can be used as a governance tool to vote on protocol upgrades and changes. Additionally, holding 1inch tokens may also provide access to special features and rewards on the platform.

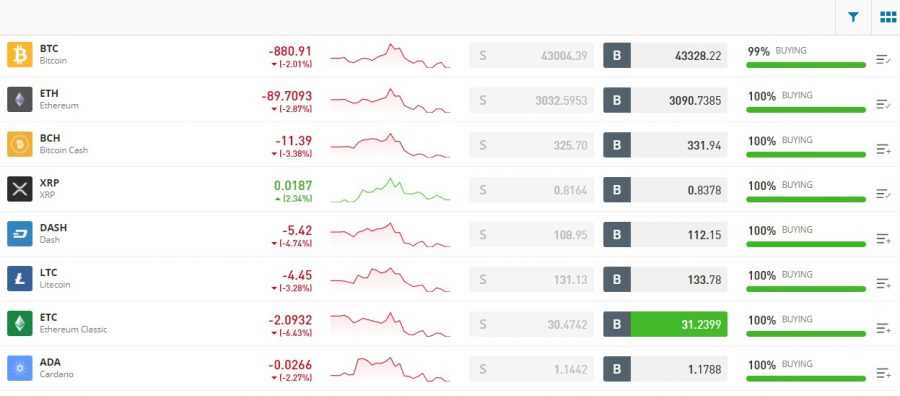

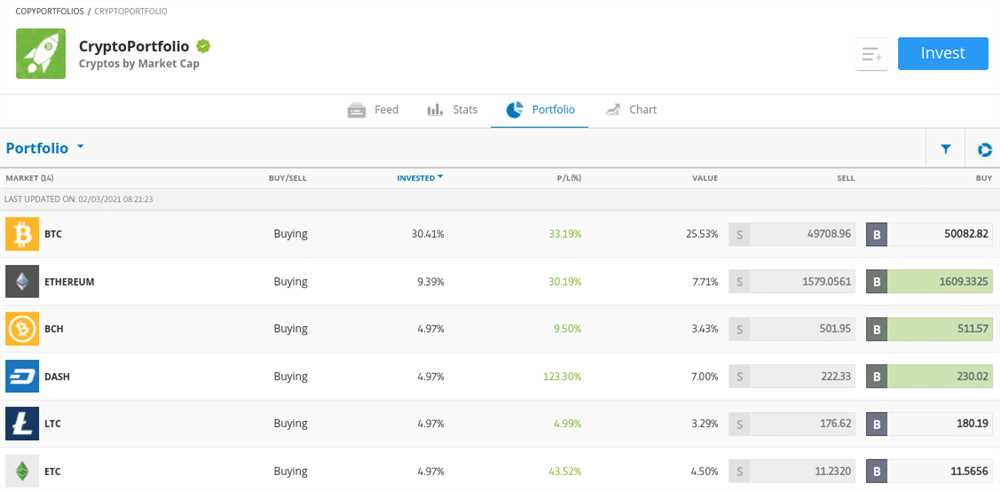

2. Market Demand: Look into the current market demand for 1inch tokens. Analyze the trading volume, liquidity, and price trends. Understanding the market dynamics can help you make an informed decision about whether or not to invest in 1inch tokens.

3. Project Team: Research the team and developers behind the 1inch project. Consider their experience, expertise, and past successes. A strong team can greatly influence the success and growth of the project.

4. Technology and Security: Evaluate the technology and security measures implemented by the 1inch platform. Assess the platform’s resilience to hacks and vulnerabilities. A secure and reliable platform is crucial for the long-term success of the project.

5. Competition: Consider the competitive landscape of decentralized exchanges. Look into other similar projects and assess how 1inch stands out from its competitors. Understanding the market position and unique value proposition of 1inch can help you gauge its potential for future growth.

6. Regulatory Environment: Keep an eye on the regulatory environment surrounding decentralized finance (DeFi) and cryptocurrency. Understand the potential risks and legal challenges that may impact the value and adoption of 1inch tokens.

7. Risk Management: Assess your own risk tolerance and investment goals before buying 1inch tokens. Consider diversifying your portfolio and only investing what you can afford to lose. Crypto investments can be volatile, so it’s important to have a well-thought-out risk management strategy.

By considering these factors, you can make a more informed decision about whether or not to buy 1inch tokens. Remember to do thorough research and seek professional advice if needed.

How to research the market and choose the right platform to buy 1inch tokens?

Before buying 1inch tokens, it is important to research the market and choose the right platform. Here are some steps to help you with the process:

1. Understand the 1inch protocol: Familiarize yourself with the 1inch protocol and its purpose. Learn about its features, partnerships, and potential for future growth. This will give you a better understanding of the tokens’ value and potential.

2. Research the market: Stay up-to-date with the latest news and developments in the cryptocurrency market. Look for information about 1inch tokens specifically, as well as the overall market trends. Consider factors such as token performance, trading volume, and community support.

3. Compare different platforms: There are numerous platforms where you can buy 1inch tokens, such as decentralized exchanges (DEXs) and centralized exchanges. Research and compare different platforms based on factors like user interface, security measures, fees, liquidity, and supported cryptocurrencies.

4. Evaluate security measures: Security should be a top priority when choosing a platform to buy 1inch tokens. Ensure that the platform has strong security measures, such as two-factor authentication, cold storage for funds, and regular security audits.

5. Consider liquidity: Liquidity is crucial when buying and selling tokens. Check the liquidity on different platforms to ensure smooth transactions and competitive pricing for 1inch tokens.

6. Check supported cryptocurrencies: If you plan to buy 1inch tokens using cryptocurrencies other than Bitcoin or Ethereum, make sure the platform supports those cryptocurrencies. Some platforms may have limited options for purchasing 1inch tokens.

7. Read user reviews and feedback: Look for user reviews and feedback about the platform you are considering. This will give you insights into the platform’s reliability, customer support, and overall user experience.

| Platform | User Interface | Security | Fees | Liquidity | Supported Cryptocurrencies |

|---|---|---|---|---|---|

| Platform A | Beginner-friendly | Strong | Low | High | Bitcoin, Ethereum, Litecoin |

| Platform B | Advanced | Medium | High | Low | Bitcoin, Ethereum, Ripple |

| Platform C | Beginner-friendly | Strong | Medium | Medium | Bitcoin, Ethereum |

8. Choose a reliable platform: Based on your research, choose the platform that best suits your needs and requirements. Consider factors such as user interface, security, fees, liquidity, and supported cryptocurrencies. Make sure the platform has a good reputation and positive user feedback.

9. Create an account: Once you have chosen a platform, sign up and create an account. Follow the platform’s instructions to complete the registration process, including any verification steps that may be required.

10. Buy 1inch tokens: After setting up your account, deposit funds into your wallet on the chosen platform and navigate to the trading section. Search for the 1inch token and specify the amount you want to buy. Review the transaction details, including fees, and confirm the purchase.

By following these steps and conducting thorough research, you can choose the right platform to buy 1inch tokens and make informed investment decisions.

Conducting market analysis for 1inch tokens

Before buying 1inch tokens, it is essential to conduct a thorough market analysis to make informed investment decisions. Market analysis involves studying various factors that can influence the price and demand for 1inch tokens. Here are some key steps to consider when conducting market analysis:

1. Evaluate the project:

Start by researching and evaluating the 1inch project itself. Look into the team behind the project, their experience, and track records. Assess the project’s goals, technology, and potential use cases. Evaluate the partnerships and collaborations the project has with other companies or projects. This will help you understand the long-term viability and potential growth of 1inch tokens.

2. Study market trends:

Analyzing market trends is crucial in understanding the demand and price movements of 1inch tokens. Look into historical price charts to identify any patterns or trends. Pay attention to any news or events that might affect the cryptocurrency market as a whole. It is also important to consider the current market sentiment and investor behavior. This analysis will help you gauge whether it is a good time to buy 1inch tokens or wait for a better market condition.

3. Evaluate competitors:

Study the competitors in the decentralized finance (DeFi) space and compare their offerings to 1inch. Look into the market share, technology, and adoption of competing projects. Understanding the competitive landscape will help you assess the potential growth and adoption rate of 1inch tokens.

Additionally, keep an eye on any upcoming projects or developments that might disrupt the DeFi market. These can have a significant impact on the demand for 1inch tokens.

Remember that market analysis is not a foolproof method and investment decisions should be made based on your own research and risk appetite. It is advisable to consult with financial advisors or experts before making any investment decisions.

By conducting a comprehensive market analysis, you can gain valuable insights into the potential growth and future prospects of 1inch tokens. This knowledge can help you make educated decisions when buying and holding 1inch tokens for investment purposes.

Reviewing different platforms for purchasing 1inch tokens

When it comes to purchasing 1inch tokens, there are several platforms available that support the buying and holding of this cryptocurrency. In this section, we will take a look at some of the popular platforms that you can consider using to buy 1inch tokens.

1. UniSwap

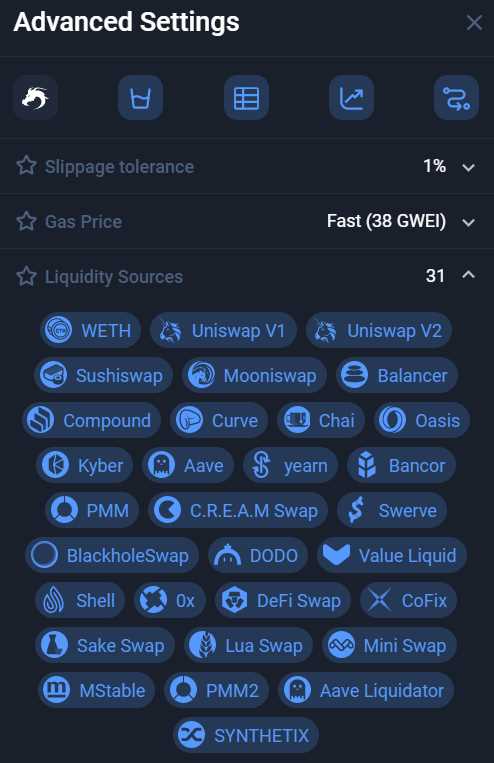

UniSwap is a decentralized exchange (DEX) built on the Ethereum blockchain. It is known for its user-friendly interface and liquidity pools. To buy 1inch tokens on UniSwap, you will need to connect your MetaMask wallet, select the token pair you want to trade (e.g., 1inch/ETH), and enter the amount you wish to purchase. UniSwap will then provide you with the best rate available and execute the transaction.

2. Binance

Binance is a centralized cryptocurrency exchange that offers a wide range of trading pairs, including 1inch tokens. To buy 1inch on Binance, you will need to create an account, deposit funds, and navigate to the trading platform. From there, you can search for the 1inch token and place a buy order based on the current market price. Binance also offers advanced trading features such as stop-loss orders and limit orders.

3. KuCoin

KuCoin is another centralized exchange that supports the trading of 1inch tokens. To purchase 1inch on KuCoin, you will need to sign up for an account, complete the verification process, and deposit funds. Once you have funded your account, you can search for the 1inch trading pair and place a market or limit order based on your preferences. KuCoin also offers a mobile app for convenient trading on the go.

4. Sushiswap

Sushiswap is a decentralized exchange protocol based on UniSwap that aims to provide more benefits to its users. To buy 1inch tokens on Sushiswap, you will need to connect your wallet and navigate to the trading platform. You can then choose the 1inch token and the token you want to trade it with, and enter the amount you wish to purchase. Sushiswap will find the best rate available and execute the transaction on your behalf.

These are just a few examples of platforms where you can purchase 1inch tokens. It’s important to do your own research, compare fees, liquidity, and security measures before choosing a platform for buying and holding 1inch tokens.

Question-answer:

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to offer users the best possible trading rates.

Which cryptocurrency exchanges support 1inch?

1inch is listed on several popular cryptocurrency exchanges, including Binance, Coinbase Pro, Kraken, Huobi, and Bitfinex.

Is it safe to buy 1inch tokens?

When buying 1inch tokens, it is important to use trusted and secure cryptocurrency exchanges, enable two-factor authentication, and store your tokens in a secure wallet. Additionally, it’s essential to do thorough research and follow best practices to mitigate any potential risks associated with buying and holding cryptocurrencies.