In the fast-paced world of cryptocurrency trading, having access to reliable and efficient platforms is crucial. This is where DEX aggregators like 1inch come into play. These platforms have revolutionized the way traders operate in decentralized exchanges (DEXs), providing them with enhanced liquidity, better prices, and simplified trading experiences.

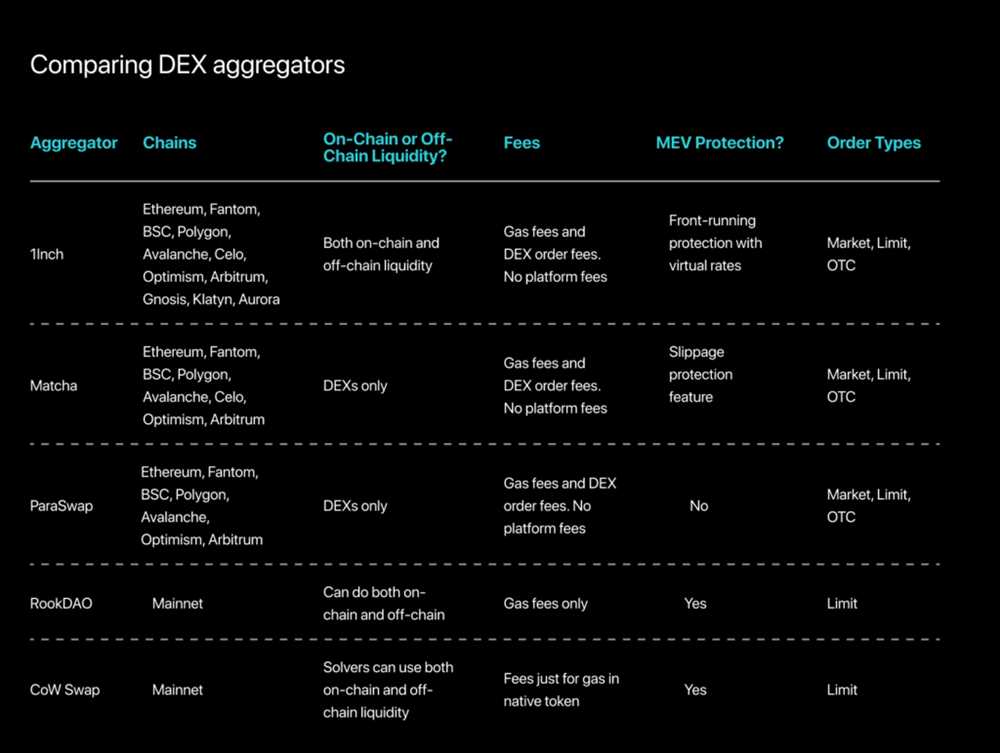

DEX aggregators act as intermediaries between multiple DEXs, allowing users to access a wide range of liquidity pools and trading pairs in a single platform. This eliminates the need for traders to manually search and compare prices across different DEXs, saving them time and effort. Additionally, DEX aggregators leverage advanced algorithms and smart contract technology to optimize trades, ensuring that users get the best possible prices.

One of the key advantages of DEX aggregators is their ability to aggregate liquidity from multiple sources. By tapping into various DEXs, these platforms are able to pool together a larger volume of tokens, resulting in deeper liquidity. This means that traders can execute larger trades without causing significant price slippage, which is a common issue in decentralized exchanges.

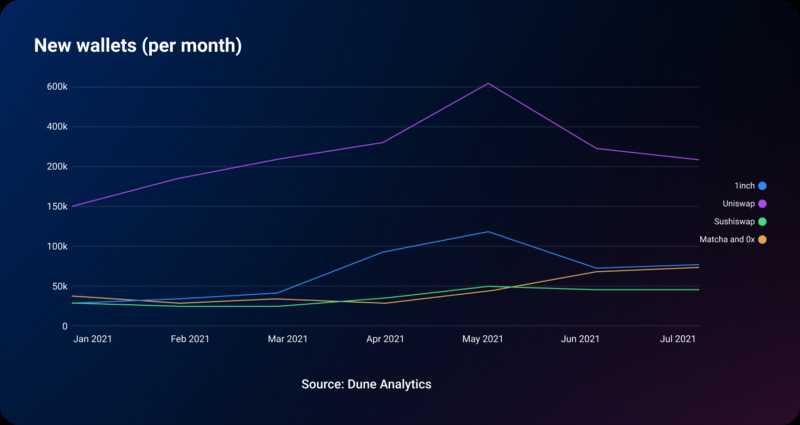

Furthermore, DEX aggregators like 1inch offer users the convenience of a single interface for trading on multiple DEXs. This makes it easier for both experienced and novice traders to navigate the decentralized trading landscape. By providing a seamless and user-friendly experience, DEX aggregators help to bridge the gap between traditional centralized exchanges and DEXs, attracting more users to the world of decentralized finance.

In conclusion, DEX aggregators like 1inch have become indispensable tools for traders in the crypto market. They not only simplify the trading process but also enhance liquidity and improve price execution. As the popularity of decentralized exchanges continues to grow, the importance of DEX aggregators in providing seamless trading experiences cannot be overstated.

Why DEX Aggregators are Crucial in the Cryptocurrency Market

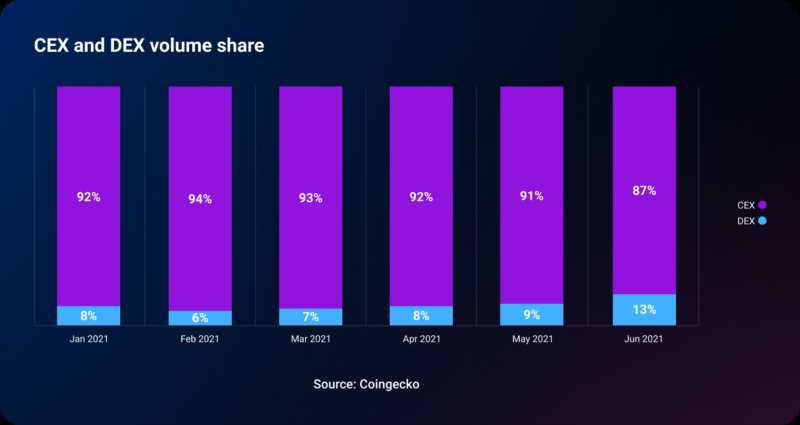

Decentralized exchanges (DEX) have gained significant popularity in the cryptocurrency market due to their ability to provide users with greater control, privacy, and security over their digital assets. However, with the increasing number of decentralized exchanges and liquidity pools, it has become challenging for traders to find the best prices and execute trades efficiently.

This is where DEX aggregators like 1inch play a crucial role. These platforms aggregate liquidity from various DEXs and provide users with access to the best available prices and liquidity across multiple decentralized exchanges.

1. Improved Liquidity and Price Discovery

By aggregating liquidity from multiple sources, DEX aggregators help to improve liquidity for traders. They provide access to a larger pool of trading opportunities and ensure that users get the best possible prices for their trades. This not only maximizes profits for traders but also reduces slippage.

Moreover, DEX aggregators facilitate price discovery by bringing together prices from multiple decentralized exchanges. This enables traders to compare prices and choose the most favorable trading routes, ensuring they get the best deals in the market.

2. Efficiency and Cost Savings

Using a DEX aggregator allows traders to avoid the hassle of manually searching and comparing prices across different decentralized exchanges. Instead, they can easily access and trade on multiple DEXs through a single interface, saving time and effort.

This efficiency also translates into cost savings. By finding the best prices and reducing slippage, traders can optimize their trading strategies and achieve better results. Additionally, DEX aggregators often offer competitive fee structures, further reducing trading costs.

3. Increased Accessibility and User-Friendliness

With DEX aggregators, users no longer need to create accounts and go through multiple KYC processes on different decentralized exchanges. They can simply connect their wallets to the aggregator platform and access multiple DEXs with a single login.

This increased accessibility and user-friendliness make DEX aggregators an attractive option for both experienced traders and newcomers to the cryptocurrency market. It lowers the barriers to entry and allows users to participate in decentralized trading with ease.

| Advantages | Disadvantages |

|---|---|

|

|

In conclusion, DEX aggregators play a crucial role in the cryptocurrency market by improving liquidity, facilitating price discovery, increasing efficiency, and reducing costs. While there are some potential drawbacks, such as centralized points of failure and security risks, the benefits of using DEX aggregators outweigh these concerns. These platforms provide traders with a convenient and user-friendly way to access multiple decentralized exchanges and optimize their trading strategies for maximum profitability.

Enhancing Liquidity and Access

One of the key benefits of DEX aggregators like 1inch in the crypto market is the enhanced liquidity and access they provide for traders and investors.

Liquidity refers to the ability to buy or sell an asset without causing a significant impact on its price. In traditional financial markets, liquidity is often provided by large institutional players and market makers. However, in the crypto market, liquidity has been a challenge due to the fragmented nature of decentralized exchanges.

DEX aggregators like 1inch solve this liquidity problem by aggregating liquidity from multiple decentralized exchanges into a single platform. This means that traders can access a larger pool of liquidity, increasing their chances of executing trades at the desired price and reducing slippage.

Moreover, DEX aggregators also provide access to a wide range of tokens that may not be available on a single exchange. This allows traders and investors to diversify their portfolios and explore new investment opportunities. Instead of going through the hassle of creating accounts on multiple exchanges, traders can simply use a DEX aggregator to access various tokens in one place.

Additionally, DEX aggregators also offer advanced features like smart routing, which automatically finds the best prices and routes trades through multiple decentralized exchanges to optimize execution. This further enhances liquidity and access for users, ensuring that they get the best possible prices for their trades.

In conclusion, DEX aggregators like 1inch play a crucial role in enhancing liquidity and access in the crypto market. By aggregating liquidity from multiple decentralized exchanges and providing access to a wide range of tokens, these platforms empower traders and investors to make more informed decisions and execute trades more efficiently.

Maximizing Profitability and Efficiency

DEX aggregators like 1inch play a crucial role in maximizing profitability and efficiency in the crypto market. By utilizing the advanced algorithms and smart contract technology, these platforms are able to scan multiple decentralized exchanges to find the best prices and liquidity for users.

One of the main advantages of using a DEX aggregator like 1inch is the ability to execute trades at the most favorable price. Instead of manually checking each individual exchange for the best rate, users can rely on the aggregator to automatically find the optimal route for their trades. This not only saves time and effort but also helps to maximize profits by ensuring that trades are executed at the best possible price.

Improved Liquidity

In addition to finding the best prices, DEX aggregators also improve liquidity for users. By accessing multiple decentralized exchanges, these platforms are able to pool together liquidity from different sources, increasing the overall depth of the market. This means that users can execute larger trades without significantly impacting the price.

Having access to improved liquidity is particularly important for traders looking to buy or sell larger amounts of cryptocurrency. Without a DEX aggregator, they may have to split their trades across multiple exchanges, resulting in higher slippage and increased costs. With the help of a DEX aggregator like 1inch, traders can access a larger pool of liquidity, allowing them to execute trades with minimal slippage and improved efficiency.

Reduced Fees

Another benefit of using a DEX aggregator is the potential for reduced fees. By accessing multiple decentralized exchanges, these platforms can compare fees across different platforms and recommend the most cost-effective options for users. This can help traders save on transaction costs, especially for larger trades where fees can add up quickly.

By maximizing profitability and efficiency, DEX aggregators like 1inch have become an essential tool for traders in the crypto market. Whether it’s finding the best prices, accessing improved liquidity, or reducing fees, these platforms provide users with the tools they need to optimize their trading strategies and make the most of their investments.

Reducing Slippage and Transaction Costs

Dex aggregators like 1inch play a crucial role in reducing slippage and transaction costs in the crypto market. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. In decentralized exchanges (DEXs), slippage can occur due to the lack of liquidity and the presence of various trading pairs with different prices.

By aggregating liquidity from multiple DEXs, 1inch is able to provide users with the best possible trading prices. The smart routing algorithms used by 1inch analyze the liquidity pools and trading pairs available across different DEXs to ensure that the trade is executed at the most favorable prices.

In addition to reducing slippage, DEX aggregators like 1inch also help in minimizing transaction costs. Transaction costs in the crypto market typically include network fees, gas fees, and exchange fees. Traditional exchanges often charge high fees for trading, which can eat into the profits of traders and investors.

When using DEX aggregators like 1inch, users can minimize these transaction costs by finding the most cost-effective trading routes. By comparing the fees charged by different DEXs, users can ensure that they are getting the best possible deal.

Moreover, DEX aggregators allow users to interact with multiple DEXs through a single interface, saving them time and effort. Instead of manually checking prices and liquidity across different DEXs, users can rely on DEX aggregators like 1inch to do the heavy lifting for them.

In summary, DEX aggregators like 1inch play a vital role in reducing slippage and transaction costs in the crypto market. They provide users with the best trading prices by aggregating liquidity from multiple DEXs and help minimize transaction costs by finding the most cost-effective trading routes. By using DEX aggregators, users can fully leverage the benefits of DEXs while minimizing the drawbacks.

Improving Security and Trust

Decentralized exchanges (DEXs) are known for their enhanced security features compared to centralized exchanges. However, there are still risks involved in trading on DEXs, such as smart contract vulnerabilities and the potential for rug pulls.

This is where DEX aggregators like 1inch play a crucial role in improving security and trust in the crypto market. By aggregating liquidity and connecting users to multiple DEXs, these platforms mitigate the risks associated with individual DEXs.

Smart Contract Audits

One of the key ways DEX aggregators improve security is by conducting thorough smart contract audits. Smart contracts are at the core of DEX functionality, and any vulnerabilities can place user funds at risk.

1inch and other aggregators work with reputable auditing firms to review the smart contracts of the DEX protocols they integrate. This process helps identify and address potential vulnerabilities before they can be exploited.

Reducing Counterparty Risk

Trading on DEXs often involves interacting directly with smart contracts, eliminating the need for a trusted intermediary. However, this exposes users to counterparty risk.

By using DEX aggregators, traders can access a wider pool of liquidity without having to trust a single DEX or counterparty. These platforms split trades across multiple exchanges while finding the best prices and reducing the risk of a single point of failure.

Moreover, DEX aggregators often implement features such as slippage protection and multi-signature wallets, further enhancing security and reducing the risk of hacks or fund mismanagement.

By improving security and trust in the crypto market, DEX aggregators like 1inch enable users to confidently navigate the decentralized trading landscape.

Question-answer:

What is a DEX aggregator?

A DEX aggregator is a platform that allows users to access multiple decentralized exchanges (DEX) from one interface, providing the best possible prices and liquidity for their trades.

How does 1inch work as a DEX aggregator?

1inch works as a DEX aggregator by splitting a user’s trade across multiple DEXs to find the most efficient price and liquidity. It uses smart contracts and algorithmic routing to achieve this, ensuring the best execution for the user.

What are the advantages of using a DEX aggregator like 1inch?

Using a DEX aggregator like 1inch allows users to access a wide range of DEXs, which increases liquidity and reduces slippage. It also offers better prices by searching for the most favorable rates across multiple exchanges. Additionally, it saves time and effort for users by providing a single interface for all their trading needs.

Are there any risks associated with using DEX aggregators?

While DEX aggregators like 1inch offer many benefits, there are some risks to be aware of. One risk is the potential of interacting with fraudulent or malicious DEXs that may be integrated into the aggregator. It is important to do thorough research and use caution when using any decentralized platform. Additionally, there may be smart contract risks and potential for hacking, so users should be cautious and ensure they are using a reputable aggregator.

How does 1inch ensure the security of user funds?

1inch ensures the security of user funds by utilizing smart contracts that execute trades directly on the blockchain. This means that users retain control of their funds at all times, and there is no need to deposit funds into a centralized exchange. Additionally, 1inch has implemented various security measures and audits to minimize the risk of vulnerabilities or hacks.