Are you looking for a simple and effective way to make passive income? Look no further than 1inch exchange! With our step-by-step guide, you’ll learn how to maximize your earnings and start making money effortlessly.

Step 1: Sign up for an account on 1inch exchange. It’s quick, easy, and free!

Step 2: Connect your wallet to the exchange. This will allow you to securely store and trade your digital assets.

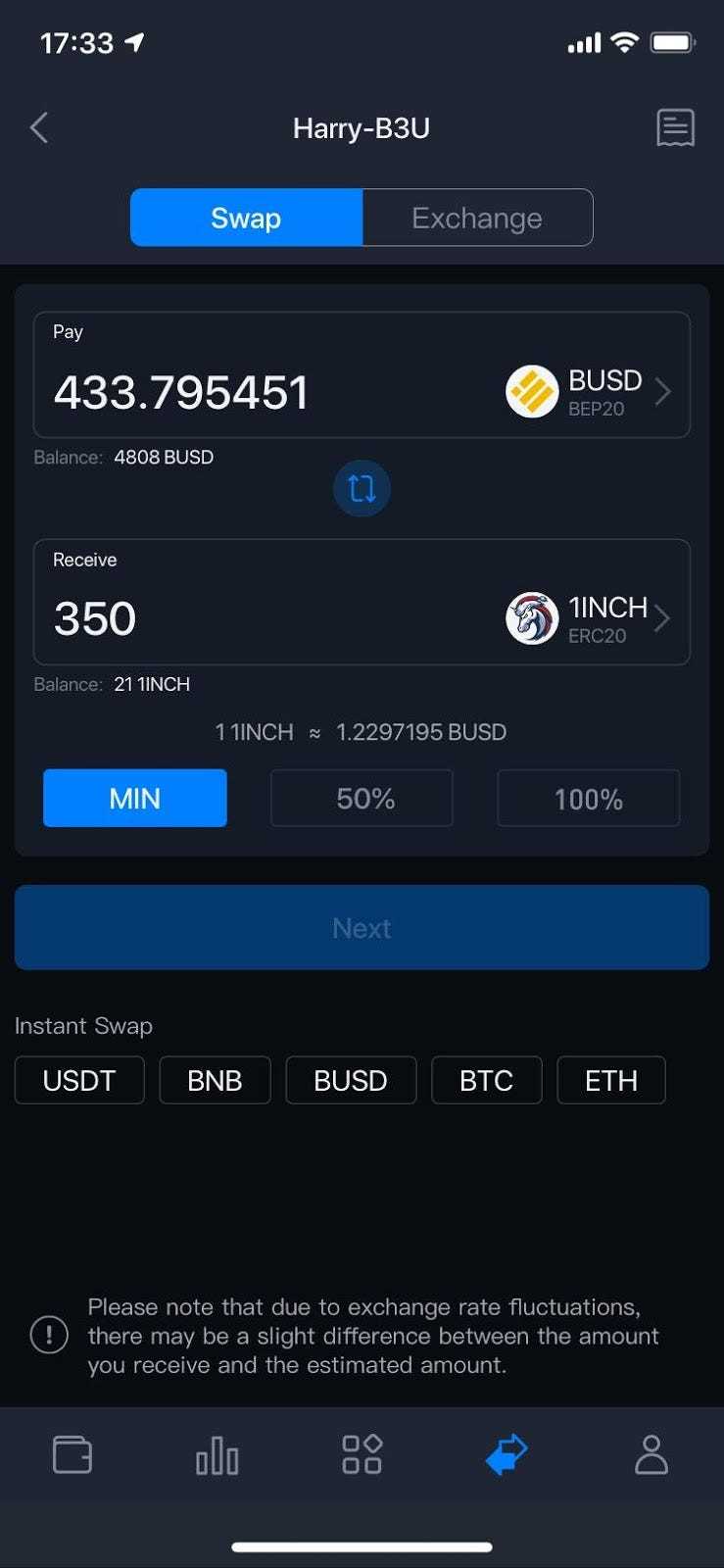

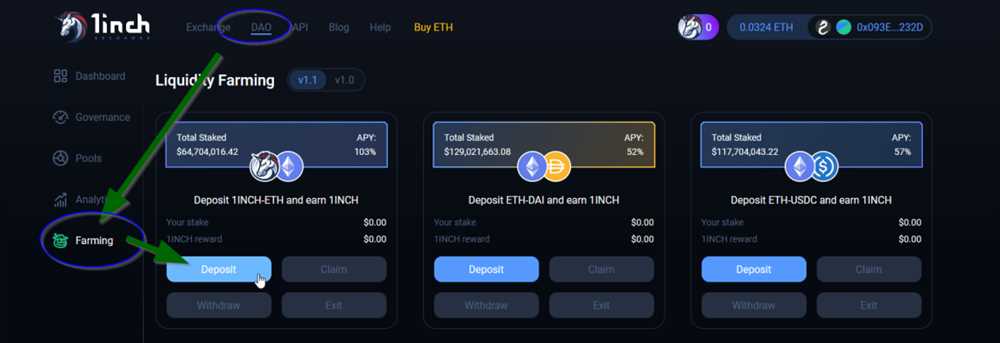

Step 3: Explore different liquidity pools on 1inch exchange. These pools allow you to earn passive income by providing liquidity to the platform.

Step 4: Choose the assets you want to provide liquidity for. This can be any combination of cryptocurrencies supported by 1inch exchange.

Step 5: Deposit your assets into the liquidity pool. This will allow you to earn fees from traders who use the pool.

Step 6: Sit back and watch your passive income grow! As more traders use the liquidity pool, you’ll earn a portion of the trading fees.

With 1inch exchange, earning passive income has never been easier. Follow our step-by-step guide and start making money today!

Achieving Passive Income on 1inch Exchange

The 1inch Exchange provides users with an opportunity to earn passive income through various strategies. By utilizing the platform’s features and taking advantage of liquidity pools, users can generate a steady income without actively trading.

Exploring Liquidity Pools

Liquidity pools are at the core of earning passive income on the 1inch Exchange. By contributing funds to these pools, users become liquidity providers and are rewarded with a share of the trading fees generated by the platform.

To get started, users can select a pool that matches their desired risk tolerance and asset allocation. By diversifying across different pools, users can minimize their risk and maximize their potential earnings.

Earning Trading Fees

As a liquidity provider on the 1inch Exchange, users earn a portion of the trading fees generated on the platform. These fees are paid by traders who utilize the liquidity provided by the pools.

The amount of passive income earned depends on the user’s share of the liquidity pool and the overall trading volume on the platform. By selecting pools with high trading volume, users can increase their potential earnings.

Furthermore, the 1inch Exchange utilizes an algorithm that optimizes trading routes across multiple decentralized exchanges. This ensures that liquidity providers can earn higher fees compared to other decentralized exchanges.

Utilizing Yield Farming Strategies

In addition to liquidity pools, users can also participate in yield farming strategies on the 1inch Exchange. Yield farming involves staking or lending assets to earn additional rewards.

The 1inch Exchange supports various yield farming protocols, allowing users to benefit from the potential returns of these strategies. By carefully selecting and managing their positions, users can maximize their passive income.

Overall, achieving passive income on the 1inch Exchange requires careful consideration of liquidity pools and yield farming strategies. By diversifying across different pools and utilizing the platform’s features, users can generate a consistent and potentially lucrative source of income.

Step 1: Selecting the Right Assets

When it comes to earning passive income on 1inch exchange, selecting the right assets is crucial. The choice of assets will determine the success of your investment and the amount of passive income you can earn.

Evaluate the Market

Before selecting the assets to invest in, it is important to evaluate the market. Consider factors such as the current trends, market demand, and potential profitability. Research different assets and their historical performance to make an informed decision.

Diversify your Portfolio

Diversifying your portfolio is a key strategy for reducing risk and maximizing potential returns. Allocate your investment across various assets, such as cryptocurrencies, tokens, or other digital assets. This will help balance your investment and protect it from potential market fluctuations.

By carefully selecting the right assets and diversifying your portfolio, you can increase your chances of earning passive income on 1inch exchange. Remember to regularly assess and adjust your investment strategy to align with market conditions and maximize your returns.

Step 2: Choosing the Best Yield Farming Strategy

Once you have familiarized yourself with the concept of passive income and the basics of the 1inch exchange, it’s time to take the next step in your journey to financial success. Now, you need to focus on selecting the best yield farming strategy that suits your investment goals and risk tolerance.

What is Yield Farming?

Yield farming, also known as liquidity mining, is the process of earning additional tokens by lending or staking your cryptocurrency assets on decentralized finance (DeFi) platforms. By participating in yield farming, you can generate passive income by providing liquidity to the various liquidity pools available on the 1inch exchange.

Factors to Consider

When it comes to choosing the best yield farming strategy, there are several factors you need to consider:

- Risk Appetite: Determine how much risk you are willing to take on. Some strategies may offer higher returns but also come with higher risks.

- Available Capital: Consider the amount of capital you have available for investment. Different strategies require different levels of investment.

- Time Horizon: Determine the length of time you are willing to commit to the yield farming strategy. Some strategies may require locking your funds for a longer period.

- Projected Returns: Assess the potential returns offered by each yield farming strategy. Compare the expected yields and choose the one that aligns with your financial goals.

Evaluating Yield Farming Projects

Before finalizing your decision, it is crucial to conduct thorough research and evaluate the yield farming projects available on the 1inch exchange. Consider the following aspects:

- Audited Projects: Look for projects that have been audited by reputable firms to ensure their security and reliability.

- Team and Community: Examine the team behind the project and assess their experience and credibility. Also, check the size and activity of the project’s community.

- Tokenomics: Review the tokenomics of the project, including the token supply, distribution, and inflation rate.

- Historical Performance: Analyze the historical performance of the project to get an idea of its stability and potential returns.

Conclusion

Choosing the best yield farming strategy requires careful consideration and research. It’s essential to align your strategy with your risk tolerance, capital, and investment goals. By evaluating the available projects and understanding their tokenomics, team, and performance, you can make an informed decision to maximize your passive income potential on the 1inch exchange.

Step 3: Maximizing Earned Income with Liquidity Mining

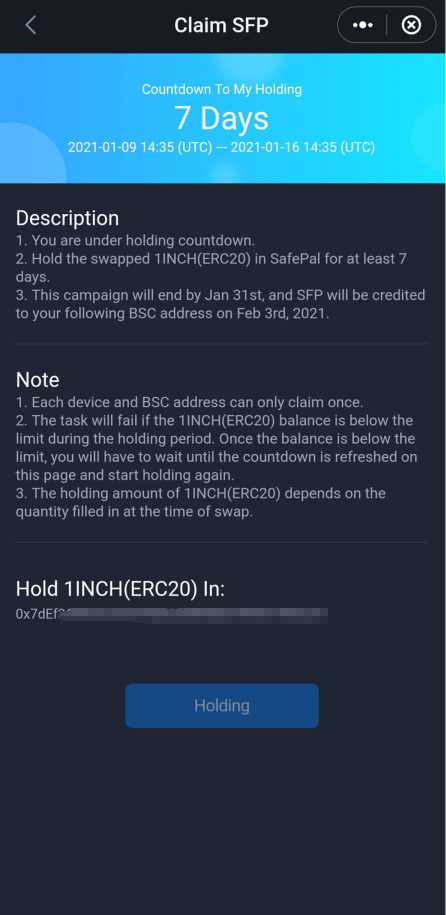

Once you have started earning passive income on 1inch exchange through trading and yield farming, you can further boost your earnings through liquidity mining. Liquidity mining is a process where you provide liquidity to the platform by depositing your tokens into liquidity pools.

By participating in liquidity mining, you become a liquidity provider and earn additional rewards in the form of tokens. These rewards are generated by transaction fees and distributed among liquidity providers based on their share of the total liquidity in the pool.

To maximize your earned income with liquidity mining, follow these steps:

- Identify the most rewarding pools: Research and identify the pools that offer the highest returns on your deposited tokens. You can check the APY (Annual Percentage Yield) and historical returns of different pools to make an informed decision.

- Deposit your tokens: Once you have identified the pools, deposit your tokens into the selected pools. Make sure to follow the instructions provided by the platform and double-check the token addresses.

- Stake your LP tokens: When you deposit your tokens into a liquidity pool, you receive LP (Liquidity Provider) tokens in return. These tokens represent your share of the pool’s liquidity. Stake your LP tokens to start earning rewards.

- Monitor and manage your positions: Keep an eye on your liquidity provider positions and make adjustments if necessary. Depending on market conditions, you may want to rebalance your portfolio or explore other pools with higher returns.

- Compound your earnings: Consider reinvesting your earned tokens back into liquidity pools to compound your earnings. By doing this, you can potentially earn even more passive income over time.

Remember, liquidity mining involves risks, such as impermanent loss and market volatility. It’s important to do thorough research and understand the risks associated with each pool before participating in liquidity mining. However, when done correctly, liquidity mining can be a powerful strategy for maximizing your earned income on 1inch exchange.

Question-answer:

What is 1inch exchange?

1inch exchange is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible rates for their trades.

How can I earn passive income on 1inch exchange?

To earn passive income on 1inch exchange, you can provide liquidity to the platform by adding your funds to liquidity pools. By doing so, you will earn a portion of the fees generated by trades on the platform.