Liquidity providers play a crucial role in the functioning of the 1inch App, a decentralized exchange aggregator that provides users with the best possible trading routes across multiple decentralized exchanges. By providing liquidity to the platform, these providers facilitate seamless and efficient trading for users.

When a user makes a trade on the 1inch App, the platform sources the best prices from various decentralized exchanges. Liquidity providers contribute to this process by supplying funds to the liquidity pools on these exchanges. This ensures that there is enough liquidity available for users to execute their trades quickly and without significant slippage.

Being a liquidity provider on the 1inch App offers several benefits. Firstly, providers earn fees from their contributed liquidity. These fees are proportionate to the amount of liquidity provided. Additionally, liquidity providers can also earn rewards in the form of governance tokens, which give them a say in the decision-making processes of the platform.

By acting as liquidity providers, individuals and entities not only earn rewards but also contribute to the overall liquidity of the decentralized finance (DeFi) ecosystem. This is important as liquidity is a key factor in attracting more users and maintaining a healthy trading environment.

Overall, liquidity providers play a crucial role in ensuring the efficiency and success of the 1inch App. Their contributions facilitate seamless trading experiences for users and help to support the growth and development of the DeFi ecosystem as a whole.

What are Liquidity Providers?

Liquidity providers (LPs) are individuals or entities that supply liquidity to decentralized exchanges (DEXs) like the 1inch App. They play a critical role in facilitating trades and enabling users to easily exchange cryptocurrencies.

When traders want to make a swap on the 1inch App, they rely on liquidity providers to provide the assets necessary for the transaction. LPs contribute to liquidity pools by depositing an equal value of both tokens in a trading pair. For example, if someone wants to trade Ethereum for Dai, a liquidity provider would supply an equivalent value of both cryptocurrencies to the Ethereum-Dai liquidity pool.

The liquidity provided by LPs makes it possible for traders to execute their transactions quickly and at a reasonable price. Without sufficient liquidity, trades could be delayed or result in substantial slippage, making it difficult for traders to get the best price for their trades.

As compensation for providing liquidity, LPs receive rewards in the form of trading fees generated by the DEX. These fees are typically a percentage of the trading volume and are distributed proportionally to liquidity providers based on their share of the pool.

By participating as liquidity providers, individuals and entities can earn passive income from their cryptocurrency holdings while simultaneously contributing to the overall efficiency and liquidity of the decentralized finance (DeFi) ecosystem.

Role of Liquidity Providers in the 1inch App

Liquidity providers play a crucial role in the functioning of the 1inch App. They are individuals or entities that supply liquidity to the platform by depositing assets into liquidity pools. These pools are used to facilitate decentralized trades and provide users with access to a wide range of tokens at competitive prices.

Providing Liquidity

When liquidity providers deposit their assets into a liquidity pool, they receive tokens that represent their share of the pool. These tokens can be used to track their proportionate ownership and can be redeemed for the underlying assets at any time. By providing liquidity, providers enable users to swap tokens and execute trades without relying on centralized exchanges.

By providing liquidity, providers earn a share of the trading fees generated by the platform. The fees are distributed proportionally to the liquidity providers based on their share of the total pool. This incentivizes liquidity providers to participate and ensures a constant supply of liquidity on the platform.

Benefits and Risks

Being a liquidity provider on the 1inch App comes with its benefits and risks. By providing liquidity, providers can earn a passive income through trading fees. Additionally, they contribute to the efficiency and accessibility of the decentralized finance (DeFi) ecosystem.

However, there are also risks involved. The value of assets in the liquidity pool can fluctuate, resulting in impermanent loss for liquidity providers. Impermanent loss occurs when the value of the deposited assets changes relative to each other. Providers should carefully consider the potential risks and rewards before deciding to become liquidity providers.

Conclusion

Liquidity providers play a vital role in the 1inch App by supplying liquidity to facilitate decentralized trades. They earn a share of the trading fees generated and contribute to the accessibility and efficiency of the DeFi ecosystem. While there are risks involved, the rewards of being a liquidity provider can make it a lucrative endeavor for those willing to take on these risks.

Benefits of Being a Liquidity Provider on 1inch

Becoming a liquidity provider on 1inch can offer numerous benefits for both experienced traders and those new to the world of decentralized finance. Here are some of the key advantages:

1. Earning Passive Income

By providing liquidity to the 1inch ecosystem, you can earn passive income in the form of trading fees. Every time a trade is executed using your liquidity, a portion of the fees generated is distributed to liquidity providers. This can be a lucrative source of income, especially during periods of high trading volume.

2. Access to Unique Opportunities

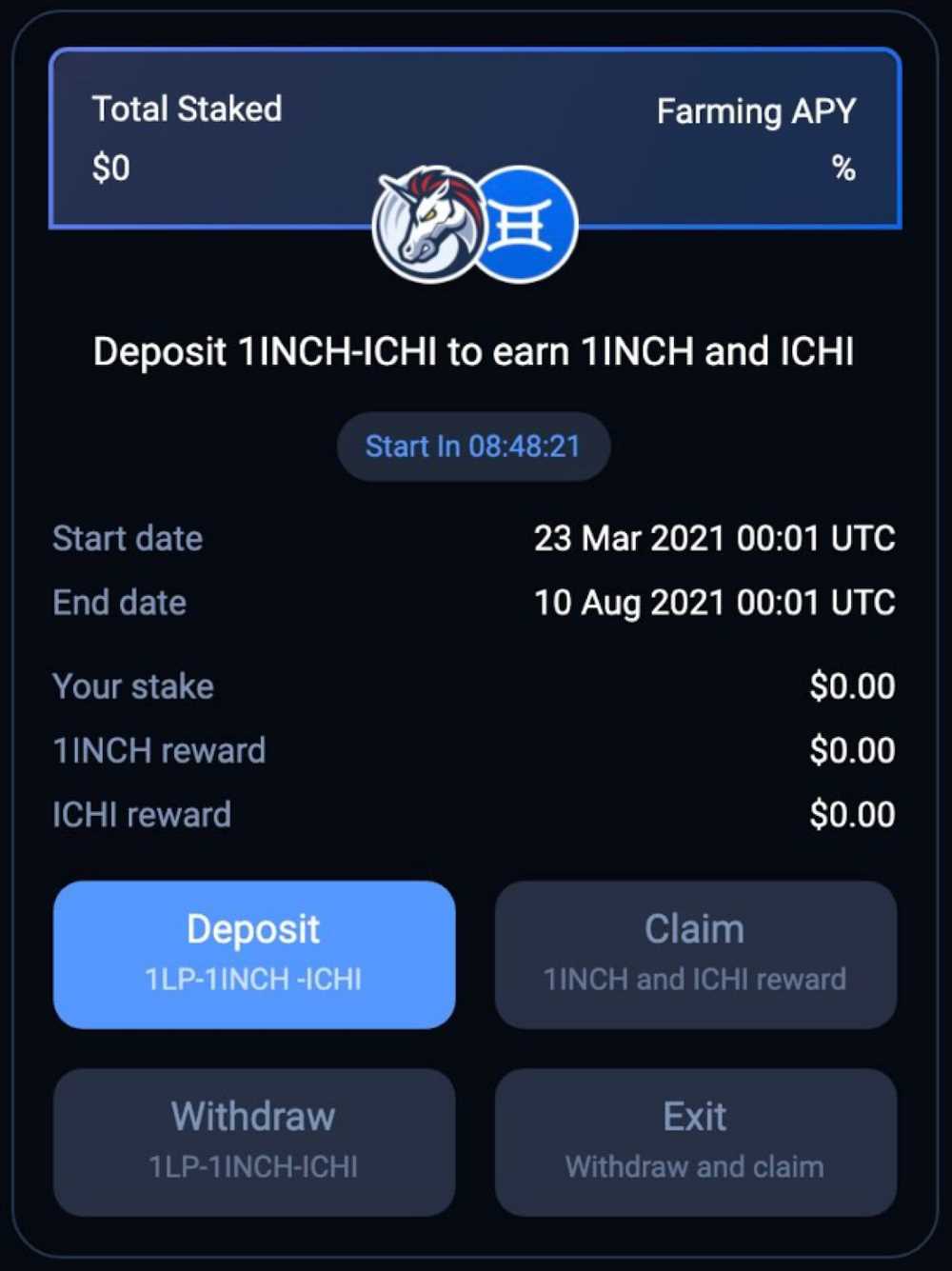

As a liquidity provider, you gain access to unique opportunities and benefits on the 1inch platform. This includes participation in liquidity mining programs, where you can earn additional rewards by supplying liquidity to specific pools. Additionally, being a liquidity provider allows you to participate in governance and decision-making processes within the 1inch ecosystem.

3. Price Improvements

Being a liquidity provider on 1inch can also lead to price improvements for traders. The platform leverages its aggregator functionality to find the best possible prices across multiple decentralized exchanges, ensuring that traders can execute their trades at the most favorable rates. By providing liquidity, you contribute to this price discovery process, resulting in better trading opportunities for all users.

4. Lower Slippage

Slippage refers to the difference between the expected price of a trade and the actual executed price. By providing liquidity, you help to mitigate slippage and improve trade execution for users of the 1inch platform. This is particularly beneficial for large trades, where even small slippage can have a significant impact on overall trade execution costs.

5. Diversification and Risk Management

As a liquidity provider on 1inch, you have the opportunity to diversify your crypto assets and manage your risk exposure effectively. By providing liquidity to multiple pools, you can spread your investment across different assets and hedge against potential losses. This diversification can help protect your investment and reduce the overall risk associated with providing liquidity.

In conclusion, being a liquidity provider on the 1inch app offers a range of benefits, including passive income, access to unique opportunities, price improvements, lower slippage, and risk management. These advantages make liquidity provision an attractive option for individuals looking to participate in the vibrant world of decentralized finance.

Make Profit and Earn Fees as a Liquidity Provider

Being a liquidity provider on the 1inch App not only helps improve the overall user experience, but it also provides an opportunity to make a profit and earn fees.

As a liquidity provider, you contribute liquidity to the 1inch liquidity pools. This means that you supply tokens to the pools, allowing users to easily swap between different assets. By doing so, you ensure that there is enough liquidity available for trades, which improves the efficiency of the platform.

In return for providing liquidity, you are rewarded with fees. These fees are paid by users who make trades on the 1inch App. The fees are proportional to the amount of liquidity you have provided. The more liquidity you provide, the higher your share of the fees will be.

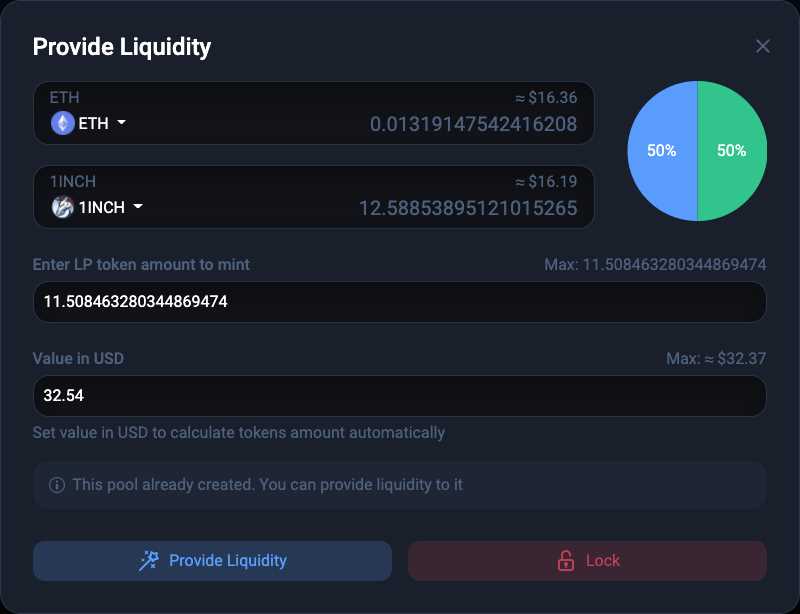

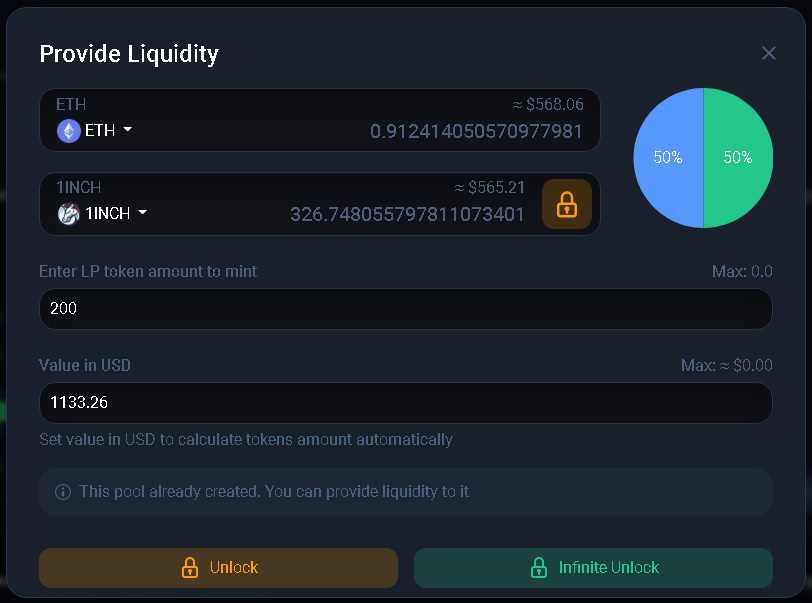

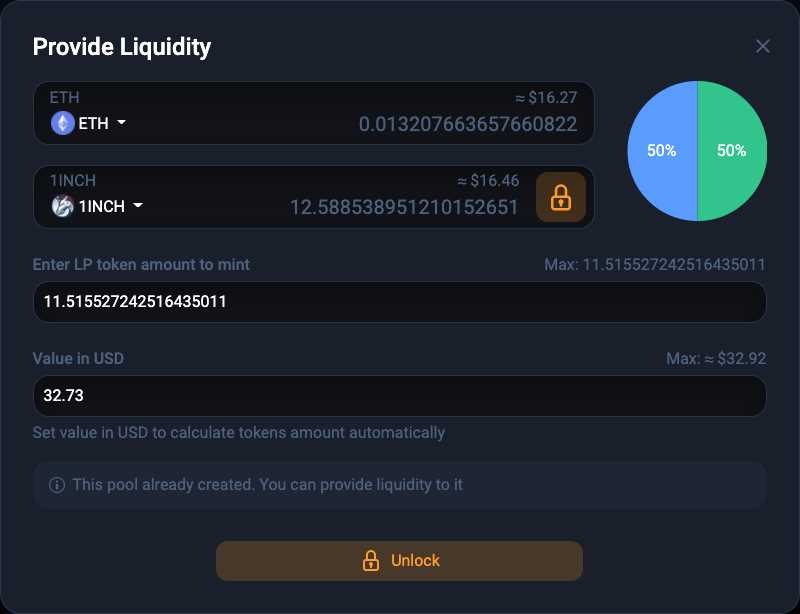

To become a liquidity provider, you need to deposit an equal value of two tokens into the 1inch liquidity pools. For example, if you want to provide liquidity for ETH and DAI, you would need to deposit an equal value of both tokens.

Once you have provided liquidity, you will receive LP tokens in return. These LP tokens represent your share of the liquidity pool. You can use these LP tokens to redeem your share of the fees earned by the liquidity pool.

It is important to note that being a liquidity provider comes with risks. The value of the tokens you have provided can fluctuate, which can affect the overall value of your investment. Additionally, there is the risk of impermanent loss, which occurs when the price ratio between the two tokens in the liquidity pool changes.

| Liquidity Provider Benefits | Liquidity Provider Risks |

|---|---|

| – Earn fees on trades made on the 1inch App | – Risk of token value fluctuation |

| – Receive LP tokens representing your share of the liquidity pool | – Risk of impermanent loss |

| – Contribute to the efficiency of the platform |

In conclusion, becoming a liquidity provider on the 1inch App allows you to make a profit and earn fees by providing liquidity to the platform. However, it is vital to understand and manage the risks associated with being a liquidity provider.

Contribute to the Efficiency of the 1inch DEX Aggregator

By becoming a liquidity provider on the 1inch app, you can play a crucial role in enhancing the efficiency of the platform. Liquidity providers are an integral part of the decentralized finance (DeFi) ecosystem as they supply the necessary assets for trading and help ensure smooth and efficient operations.

Benefits of Being a Liquidity Provider

When you provide liquidity on the 1inch DEX aggregator, you can enjoy several benefits:

- Earn Passive Income: As a liquidity provider, you earn fees for providing liquidity to the platform. These fees are distributed based on your contribution, allowing you to earn a passive income.

- Increase Trading Volume: By providing liquidity, you enable traders to execute their trades with minimal slippage. This attracts more users to the platform, increasing the overall trading volume.

- Reduce Market Manipulation: Liquidity providers play a vital role in reducing the risk of market manipulation. By providing ample liquidity, they make it harder for malicious actors to manipulate the prices of assets.

- Contribute to the DeFi Movement: By participating as a liquidity provider, you become an active contributor to the decentralized finance movement, promoting financial inclusivity and innovation.

Becoming a Liquidity Provider on the 1inch App

To become a liquidity provider on the 1inch app, you need to follow these steps:

- Connect your wallet to the 1inch app.

- Select the assets you want to provide liquidity for.

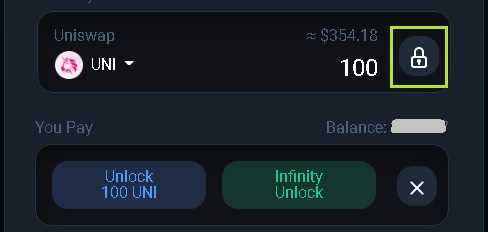

- Specify the amount of each asset you want to deposit.

- Approve the transaction and confirm the deposit.

- Once your assets are deposited, you will start earning fees for providing liquidity to the platform.

It’s important to note that providing liquidity involves some risks, such as impermanent loss and smart contract vulnerabilities. Therefore, it’s essential to do thorough research and understand the risks before becoming a liquidity provider.

Summary

Becoming a liquidity provider on the 1inch app allows you to contribute to the efficiency of the platform and enjoy several benefits. By providing liquidity, you can earn passive income, increase trading volume, reduce market manipulation, and contribute to the DeFi movement. However, it’s crucial to be aware of the risks involved and conduct proper research before participating as a liquidity provider.

| Key Points |

|---|

| • Liquidity providers enhance the efficiency of the 1inch DEX aggregator. |

| • Being a liquidity provider allows you to earn passive income and increase trading volume. |

| • Liquidity providers play a role in reducing market manipulation. |

| • Becoming a liquidity provider contributes to the decentralized finance movement. |

| • Providing liquidity involves risks such as impermanent loss and smart contract vulnerabilities. |

Question-answer:

What is a liquidity provider and why are they important on the 1inch app?

A liquidity provider is an individual or entity that deposits funds into a liquidity pool on the 1inch app, allowing users to trade between different cryptocurrencies. They are important because they help ensure that there are enough funds available for trades to take place, and they earn fees for providing this liquidity.

How do liquidity providers earn money on the 1inch app?

Liquidity providers on the 1inch app earn money by providing liquidity to the platform. When users make trades, they pay fees which are distributed to liquidity providers based on their share of the pool. So the more liquidity a provider contributes, the more fees they can earn.

What are the risks for liquidity providers on the 1inch app?

There are several risks for liquidity providers on the 1inch app. One risk is impermanent loss, which occurs when the price ratio between the two tokens in a liquidity pool changes. Another risk is smart contract risk, as bugs or vulnerabilities in the smart contract could result in funds being lost or stolen. Additionally, there is the risk of market volatility, as sudden price movements can impact the value of the funds provided as liquidity.