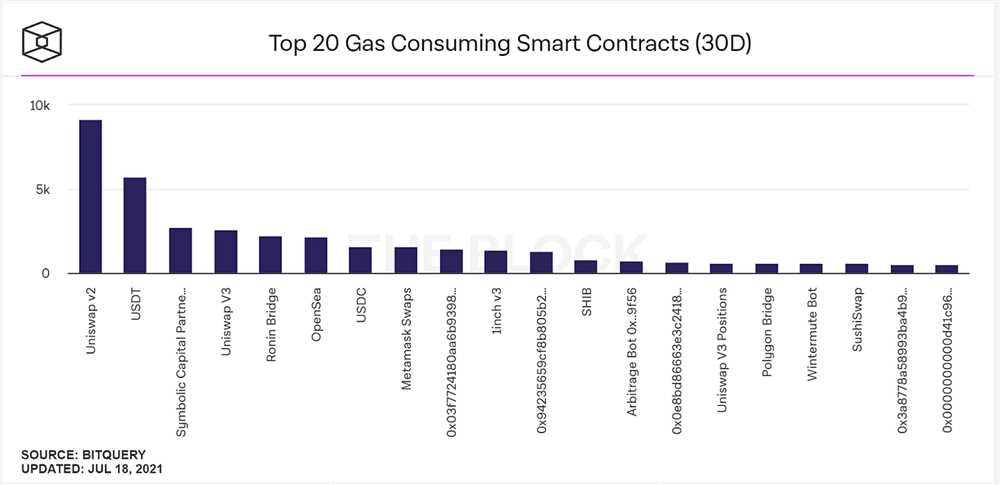

Gas fees play a crucial role in the world of cryptocurrency trading, especially on decentralized exchanges like 1inch. These fees, which are paid to miners on the Ethereum network, can greatly impact a trader’s profitability and overall experience on the platform.

When executing a trade on 1inch, users need to pay gas fees to ensure their transactions are processed quickly and securely. Gas fees are determined by several factors, including the complexity of the transaction and the current demand for Ethereum network resources. As a result, gas fees can vary greatly, sometimes reaching exorbitant levels during periods of high network congestion.

The impact of gas fees on trading is significant. High gas fees can eat into a trader’s profits, making it less attractive to make frequent and small trades. Additionally, increased gas fees can deter new traders from entering the market or experimenting with different trading strategies. This can limit the growth of the trading community on 1inch and hinder the overall development of the platform.

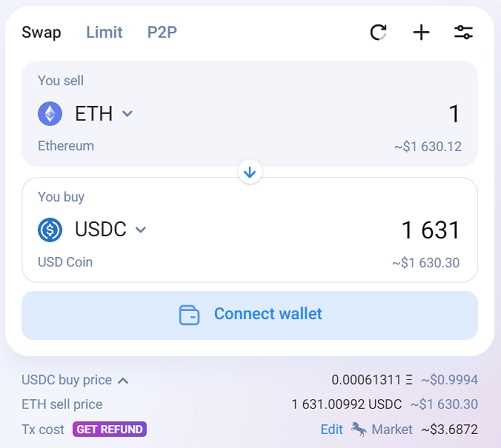

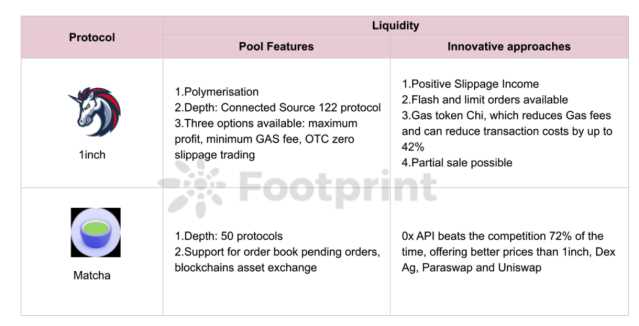

However, 1inch strives to minimize the impact of gas fees on its users. The platform employs various strategies, such as using advanced algorithms to optimize transactions and reduce gas costs. Additionally, 1inch integrates with multiple liquidity sources, allowing users to find the best rates and reduce the number of transactions needed to execute a trade. These measures help mitigate the effects of gas fees and improve the trading experience for users on 1inch.

The Impact of Gas Fees on Trading on 1inch Exchange

Gas fees play a significant role in the trading experience on the 1inch Exchange. Gas fees, also known as transaction fees, are the costs associated with executing operations on the Ethereum blockchain. These fees are paid to miners who validate and process transactions.

For traders on the 1inch Exchange, gas fees can impact several aspects of their trading activities. Firstly, high gas fees can increase the overall cost of trading. When gas fees are high, executing trades becomes more expensive, and traders may need to pay a larger amount to complete their transactions.

Moreover, gas fees can also affect the speed at which trades are executed. If gas fees are low, transactions can be processed quickly by miners, resulting in faster confirmation times. However, when gas fees are high, miners prioritize transactions with higher fees, leading to longer confirmation times for trades on the 1inch Exchange.

Gas fees can also impact the profitability of trading on the 1inch Exchange. When gas fees are high, the cost of executing trades can eat into potential profits. Traders need to carefully consider the gas fees associated with each trade to ensure that the potential gains outweigh the fees.

Furthermore, high gas fees can also cause traders to hesitate or avoid making certain trades altogether. If the gas fees are too high compared to the potential profits of a trade, traders may opt to wait for lower fees or explore other trading platforms with lower transaction costs.

To mitigate the impact of gas fees on trading, 1inch Exchange users can monitor and track the current gas fee prices before executing trades. By keeping an eye on the gas prices, users can choose the optimal time to trade when gas fees are relatively lower.

In conclusion, gas fees have a substantial impact on trading on the 1inch Exchange. They can increase trading costs, affect transaction speeds, and influence the profitability of trades. Traders need to be aware of the current gas fee prices and consider them when planning their trading activities on the 1inch Exchange.

Understanding Gas Fees

Gas fees play a crucial role in the functioning of decentralized exchanges like 1inch. It is important to understand what gas fees are and how they impact trading on the platform.

What are Gas Fees?

In the Ethereum network, gas fees represent the cost of computational resources required to execute a transaction or perform a smart contract operation. Gas fees are denominated in ether (ETH) and are paid by users to incentivize miners to include their transactions in the blockchain.

Gas fees are necessary to prevent spam and abuse in the Ethereum network. They ensure that the network remains secure and the resources are allocated efficiently.

Factors Affecting Gas Fees

Gas fees are determined by various factors, including:

- Network congestion: When the Ethereum network is congested with a high number of transactions, gas fees tend to increase as users compete to have their transactions included in the next block.

- Gas Price: Gas price is the amount of ether a user is willing to pay for each unit of gas. Higher gas prices result in faster transaction processing, but also increase the overall cost.

- Transaction complexity: The more complex the transaction or smart contract operation, the higher the gas fees. This is because it requires more computational resources to execute.

Impact of Gas Fees on Trading

Gas fees directly impact trading on decentralized exchanges like 1inch. High gas fees can make trading costly, especially for smaller trades. Users may have to pay a significant amount of ETH just to submit a transaction or swap tokens.

Moreover, high gas fees can lead to delays in transaction processing. This can result in missed trading opportunities and frustration among traders.

Therefore, it is important for traders to consider gas fees when using 1inch or any other decentralized exchange. They should evaluate the current network conditions and gas prices before making a trade to optimize their trading experience.

Effect on 1inch Exchange

Gas fees can have a significant impact on trading activities on the 1inch Exchange. As gas fees are determined by the network congestion and the amount of computational resources required to process a transaction, high gas fees can make trading expensive and unfeasible for certain users.

1inch Exchange operates on the Ethereum network, which has been known for its high gas fees during periods of increased network activity. These high gas fees can result in increased transaction costs, making it less attractive for users to engage in frequent or small trades on the platform.

Furthermore, the high gas fees can also lead to delays in transaction processing. When network congestion is high, transactions may take a longer time to confirm, causing inconvenience and potential losses for traders. This can be especially problematic when dealing with time-sensitive trades or high-frequency trading strategies.

However, despite the challenges posed by gas fees, 1inch Exchange has implemented various measures to mitigate their impact. The platform offers users the option to adjust the gas price for their transactions, allowing them to prioritize speed or cost-effectiveness based on their preferences.

Additionally, 1inch Exchange continuously explores layer 2 solutions and alternative networks to provide users with lower-cost trading options. By leveraging technologies such as optimistic rollups and sidechains, the platform aims to reduce gas fees while maintaining fast and reliable trading experiences.

Overall, gas fees can have both immediate and long-term effects on trading activities on the 1inch Exchange. While they may increase costs and introduce delays, the platform actively seeks solutions to minimize these impacts and provide users with more accessible and efficient trading experiences.

Strategies for Dealing with High Gas Fees

Gas fees can often be a significant consideration when trading on the 1inch Exchange. These fees are required to process transactions on the Ethereum network and can vary greatly depending on network congestion and other factors. However, there are strategies that traders can employ to minimize the impact of high gas fees:

1. Timing Your Trades

One strategy is to carefully time your trades to take advantage of periods of lower network congestion. Gas fees tend to spike during times of high demand, such as when there is a surge in trading activity or when popular decentralized applications are being used extensively. By monitoring network activity and identifying periods of lower congestion, you can plan your trades accordingly and potentially save on gas fees.

2. Using Layer 2 Solutions

Another strategy is to explore the use of layer 2 solutions, such as the Polygon network, to reduce gas fees. Layer 2 solutions are built on top of the Ethereum network and offer faster and cheaper transactions. By moving your trades to layer 2, you can potentially save on gas fees while still benefiting from the security and liquidity of the Ethereum network.

It’s important to note that moving to layer 2 does come with its own considerations, such as the need to bridge your assets to the layer 2 network and the potential for additional complexity when interacting with decentralized applications. However, for traders looking to mitigate the impact of high gas fees, layer 2 solutions can be worth exploring.

Conclusion:

While gas fees can be a barrier to trading on the 1inch Exchange, there are strategies available to help minimize their impact. By carefully timing your trades and exploring the use of layer 2 solutions, you can potentially save on gas fees and improve your trading experience. It’s important to stay informed about network conditions and be prepared to adapt your strategy as the Ethereum ecosystem evolves.

Question-answer:

What is the gas fee and why is it important in trading on the 1inch Exchange?

Gas fee is the amount of cryptocurrency required to complete a transaction on the Ethereum blockchain. It is important in trading on the 1inch Exchange because it determines the cost of executing trades and interacting with the platform. Higher gas fees can make trading more expensive and may discourage users from participating in certain transactions.

How do gas fees impact the speed of trading on the 1inch Exchange?

Gas fees can impact the speed of trading on the 1inch Exchange as higher gas fees may result in slower transaction processing times. When gas fees are high, miners prioritize transactions with higher fees, which can lead to delays in the confirmation and execution of trades. This can be frustrating for traders who want to take advantage of price movements quickly.